On 31 December 20x0, Carmen Corporation granted 10,000 share options to 35 employees. The share options would

Question:

On 31 December 20x0, Carmen Corporation granted 10,000 share options to 35 employees. The share options would vest at 31 December 20x3 provided the employees remained in service until then. The share options had a life of five years. The exercise price was $0.85, which was the same as Carmen’s share price at the date of grant.

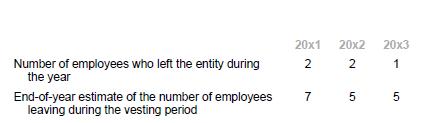

At the date of the grant, Carmen Corporation concluded that it could not estimate reliably the fair value of the share options granted. The number of employees leaving the entity and the number of employees expected to leave during the vesting period are as follows:

Carmen’s share price during the years 20x1 to 20x5, and the number of share options exercised during the years 20x4 and 20x5, are set out below. Assume that the share options that were exercised during a particular year were all exercised at the end of that year. Ignore taxation.

Required

1. Calculate the remuneration expense for each year from 20x1 to 20x5.

2. Prepare journal entries at the end of each year.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah