On 1 January 20x1, P Co entered into an agreement with Tuscany Co to acquire the net

Question:

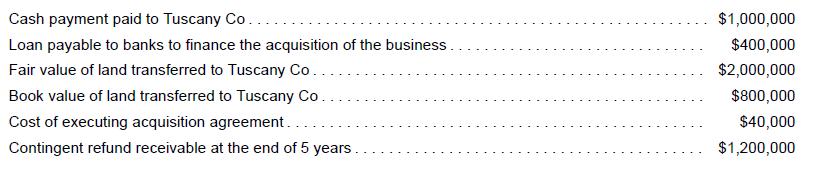

On 1 January 20x1, P Co entered into an agreement with Tuscany Co to acquire the net assets and business of Tuscany Co. The following transactions arose on 1 July 20x1 to execute the agreement with respect to the acquisition.

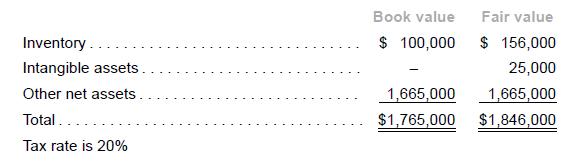

Under the acquisition agreement, Tuscany Co will refund P Co $1,200,000 if Tuscany fails to meet profit targets. P Co estimates that there is 50% probability of receiving the refund at the end of five years. The cost of capital of Tuscany Co is 5% per annum while that of P Co is 3% per annum. The fair and book values of identifiable net assets of Tuscany Co at date of acquisition were as follows:

Required

1. Prepare the journal entries to recognize the acquisition in P Co’s books and other related entries during the year ended 31 December 20x1.

2. Prepare journal entries for the year ended 31 December 20x2.

3. Assuming that the acquired business met profit targets at the end of five years, what journal entry should P Co pass as at that date?

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah