On January 1, 20X1, Priority Corporation purchased 90 percent of the common stock of Tall Corporation at

Question:

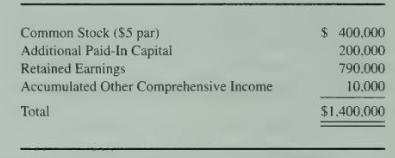

On January 1, 20X1, Priority Corporation purchased 90 percent of the common stock of Tall Corporation at underlying book value. Priority uses the equity method in accounting for its investment in Tall. The stockholders' equity section of Tall at January 1, 20X5, contained the following balances:

During 20X4, Tall sold goods costing \(\$ 30,000\) to Priority for \(\$ 45,000\). and Priority resold 60 percent prior to year-end. The reminder was sold in 20X5. Also in 20X4, Priority sold inventory items costing \(\$ 90,000\) to Tall for \(\$ 108,000\). Tall resold \(\$ 60,000\) of its purchases in \(20 \mathrm{X} 4\) and the remaining \(\$ 48,000\) in \(20 \times 5\).

In 20X5, Priority sold additional inventory costing \(\$ 30,000\) to Tall for \(\$ 36,000\), and Tall resold \(\$ 24,000\) prior to year-end. Tall sold inventory costing \(\$ 60,000\) to Priority in \(20 \mathrm{X} 5\) for \(\$ 90,000\), and Priority resold \(\$ 48,000\) of its purchase by December 31, 20X5.

Priority reported 20X5 income from its separate operations of \(\$ 240.000\) and paid dividends of \(\$ 150,000\). Tall reported 20X5 net income of \(\$ 90,000\) and comprehensive income of \(\$ 110,000\). Tall reported other comprehensive income of \(\$ 10,000\) in 20X4. In both years, other comprehensive income arose from an increase in the market value of securities classified as available-for-sale. Tall paid dividends of \(\$ 60,000\) in \(20 \times 5\).

\section*{Required}

a. Compute the balance in the investment account reported by Priority at December 31, 20X5.

b. Compute the amount of investment income reported by Priority on its investment in Tall for \(20 \times 5\).

c. Compute the amount of income assigned to noncontrolling shareholders in the 20X5 consolidated income statement.

d. Compute the balance assigned to noncontrolling shareholders in the consolidated balance sheet prepared at December 31, 20X5.

e. Priority and Tall report inventory balances of \(\$ 120.000\) and \(\$ 100.000\), respectively, at December 31, 20X5. What amount should be reported as inventory in the consolidated balance sheet at December 31, 20X5?

f. Compute the amount reported as consolidated net income for \(20 \times 5\).

g. Prepare the eliminating entries needed to complete a consolidation workpaper as of December 31, 20X5.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King