On January 1, 20X5, Paco Ltd. purchased 70% of the common shares of Scot Ltd. for $506,100.

Question:

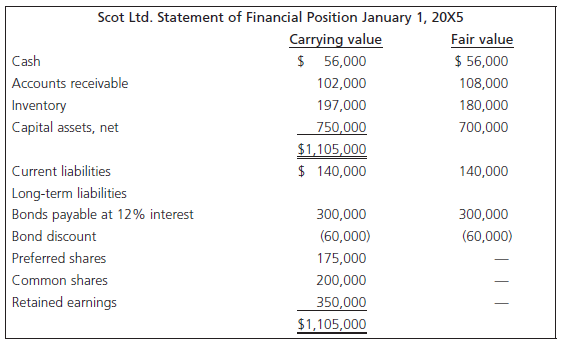

Financial data for Scot Ltd. are as follows:

Additional Information

1. Accounts receivable will be collected within the year.

2. Inventory is on the FIFO method and has a turnover of two times per year.

3. The capital assets are being written off over 10 years on a straight-line basis.

4. Any goodwill on the purchase will be tested for impairment on an annual basis.

5. The bond discount is being amortized over the remaining 10 years on a straight-line basis. Interest is payable semi-annually.

6. The preferred shares are non-cumulative, non-participating, and redeemable at par ($100) plus a $2 premium.

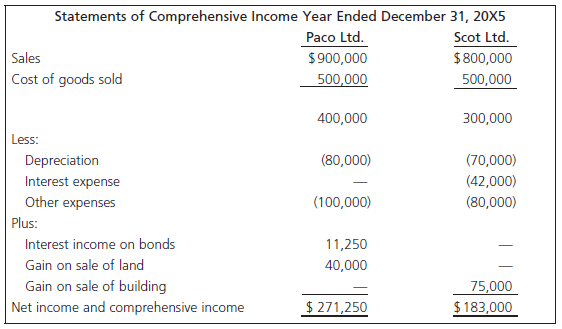

During the year, the consolidated entity had the following intercompany transactions:

1. Scot Ltd. sold a building, which had a cost of $300,000 and had accumulated depreciation of $180,000 at the date of sale, to Paco Ltd. for $195,000 cash. (This building was being depreciated over 10 years straight-line with no residual value, but no depreciation had been recorded for the year 20X5 to the date of sale.) It is company policy that assets receive a full year€™s depreciation in the year of acquisition and none in the year of disposal. It is also company policy that the acquiring company amortize the asset over the remaining life of the asset.

2. On July 1, 20X5, Paco Ltd. purchased one-half of the bonds payable of Scot Ltd. for $107,250. It is company policy that the purchaser be allocated any gain or loss on an intercompany transaction of this nature.

3. On September 1, 20X5, Paco Ltd. sold land costing $135,000D to Scot Ltd. for $175,000.

4. To date, there has been no impairment to value of goodwill.

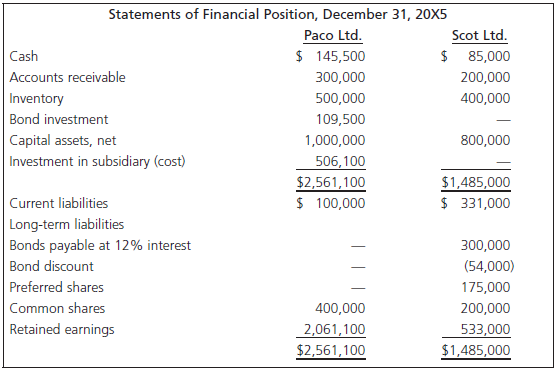

Financial statements of Paco Ltd. and Scot Ltd. as at December 31, 20X5, are:

Required

a. Prepare the consolidated statement of comprehensive income for the year 20X5.

b. Calculate the following, as they would appear on the consolidated statement of financial position at December 31, 20X5:

i) inventory;

ii) capital assets (net);

iii) bond discount; and

iv) non-controlling interest.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay