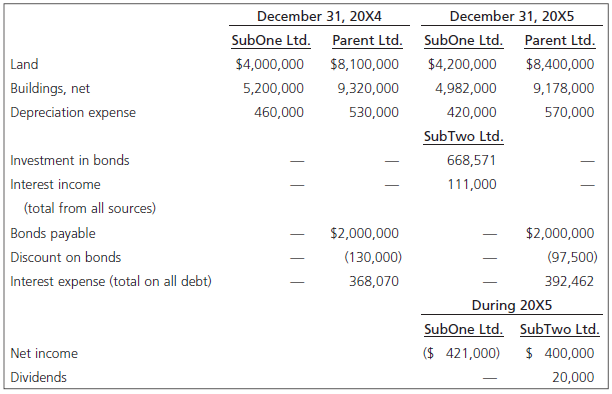

Your assistant is preparing consolidated financial statements at December 31, 20X5, for your company and has come

Question:

1. SubOne Ltd., a 70%-owned subsidiary, sold land and buildings to Parent Ltd. for $1,180,000 ($300,000 was allocated to the land). The land cost SubOne Ltd. $200,000; the building cost $1,400,000, and was 45% (i.e., nine years) depreciated at the date of sale. Parent Ltd. took a full year€™s depreciation on the building and will depreciate it over the original remaining life. SubOne Ltd. took no depreciation on the building in 20X5.

2. SubTwo Ltd., a 90%-owned subsidiary, purchased $600,000 of Parent Ltd.€™s bonds on July 1, 20X5, in the open market for $680,000. The bonds have a 12% interest rate; the interest will be paid on January 5, 20X6, and the bonds will be due on January 1, 20X9. All consolidated SCI adjustments arising from intercompany bond transactions are to be allocated between the two parties.

3. On December 1, 20X5, SubThree Ltd. split its shares four to one. Prior to the split, Parent Ltd. owned 90% of the shares (90,000 shares) of SubThree Ltd. and had the account €œInvestment in SubThree Ltd.€ on the books at $2,400,000 cost basis.

Additional Information

Required

a. For each aspect of issues 1 and 2 above, calculate the amounts that would appear on the consolidated financial statements for 20X5.

b. For issue 3, calculate the amounts that would be in the investment in subsidiary account and the journal entries that would appear on the books of Parent Ltd. If no journal entries are needed, explain why.

c. Calculate for SubOne Ltd. and SubTwo Ltd. the amount for non-controlling interest that would appear on the consolidated SCI for 20X5.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay