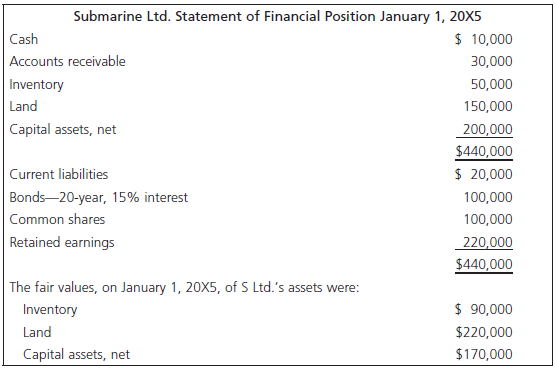

Poseidon Ltd. (P Ltd.) bought 80% of the voting shares of Submarine Ltd. (S Ltd.) for $470,000

Question:

The bonds on S Ltd.€™s statement of financial position were issued on January 1, 20X5, at face value; interest is paid July 1 and December 31.

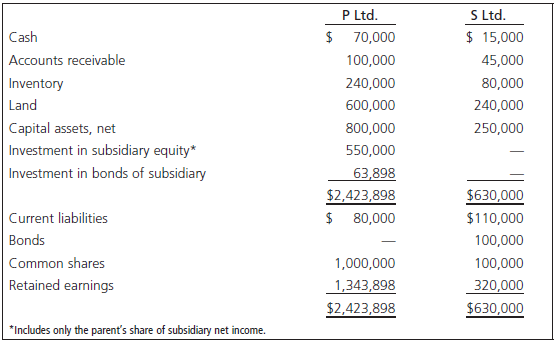

All inventory on the books of S at January 1, 20X5, was sold during the year. P sold $400,000 (cost of goods) to S for $500,000D during 20X5, and 20% of the inventory was on hand at the end of the year. P sold land to S (cost $30,000) for $90,000. P purchased $60,000 face value of S€™s bonds on July 2, 20X5, for $64,000. The premium will be amortized straightline over the remaining life of the bonds. Any goodwill will be tested on an annual basis for impairment. S€™s plant and equipment have 10 years (straight-line amortization) remaining.

S had a net income of $100,000 for 20X5 and paid no dividends.

The statements of financial position for the two companies at December 31, 20X5, are:

Required

Calculate the balances of the following selected accounts, at December 31, 20X5, that would appear on the consolidated statement of financial position. Ignore income taxes for this problem.

1. Inventory;

2. Land;

3. Capital assets;

4. Bonds payable; and

5. Retained earnings.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay