On January 1, 20X5, Pierre Company of Sherbrooke, Quebec, purchased 80% of the outstanding shares of Simon

Question:

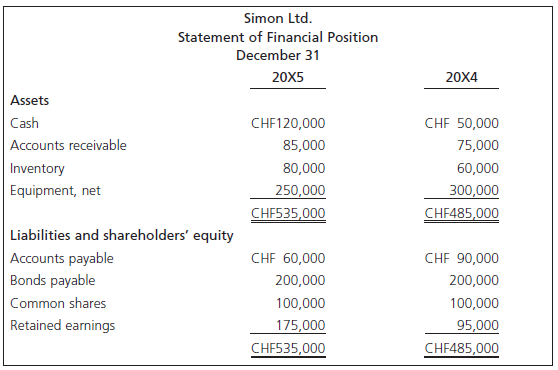

Simon Ltd.

Statement of Comprehensive Income and Retained Earnings

Year Ended December 31, 20X5

Sales...............................................................................................CHF500,000

Cost of sales.......................................................................................(280,000)

Amortization........................................................................................(50,000)

Other expenses...................................................................................(20,000)

Net income..........................................................................................150,000

Retained earnings, January 1, 20X5....................................................95,000

..............................................................................................................245,000

Dividends paid......................................................................................70,000

Retained earnings, December 31, 20X5...................................CHF175,000

Additional Information

1. Simon was incorporated on January 1, 20X2, at which time it acquired all of its equipment and issued its 10-year bonds.

2. Simon€™s purchases and sales occurred evenly during 20X5. Simon€™s December 31, 20X4, and December 31, 20X5, inventory was acquired evenly over the final six months of 20X4 and 20X5, respectively.

3. Dividends were paid on July 1, 20X5.

4. The carrying values of Simon€™s identifiable assets and liabilities approximated fair values. Any purchase price discrepancy should be assigned to goodwill. Ignore income taxes.

5. Foreign exchange rates were as follows:

January 1, 20X2...............................................................CHF1 = C$0.90

Average for July€“December 20X4.................................CHF1 = C$0.92

December 31, 20X4/January 1, 20X5............................CHF1 = C$0.94

July 1, 20X5......................................................................CHF1 = C$0.98

December 31, 20X5........................................................CHF1 = C$1.02

Average for July€“December 20X5.................................CHF1 = C$1.00

Average for 20X5............................................................CHF1 = C$0.99

Required

a. Translate the financial statements of Simon as at December 31, 20X5, assuming that Simon€™s functional currency is the Swiss franc. Include a separate calculation of any translation gain or loss on the fair value increment related to goodwill.

b. Translate the financial statements of Simon for the year ended December 31, 20X5, assuming that Simon€™s functional currency is the Canadian dollar.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay