On January (1,20 mathrm{X} 1), Speedy Plumbers issued shares of its ($ 5) par value stock to

Question:

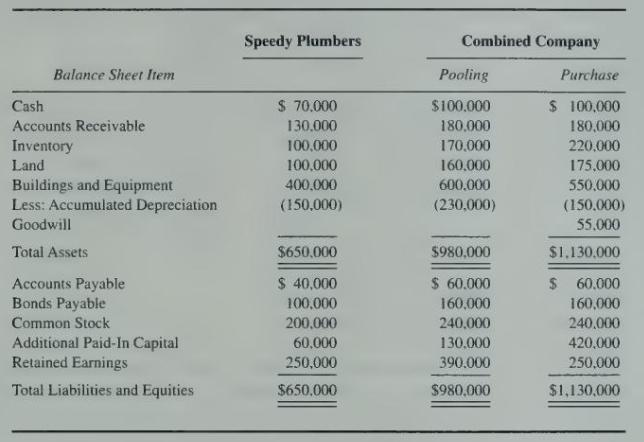

On January \(1,20 \mathrm{X} 1\), Speedy Plumbers issued shares of its \(\$ 5\) par value stock to acquire all the shares of Flash Heating Company, which was liquidated immediately thereafter. The balance sheet for Speedy Plumbers and balance sheets for the combined company under both purchase and pooling of interests treatment are presented.

\section*{Required}

Shortly after the above information was compiled, a fire destroyed the accounting records. You have been employed to determine the answers to a number of questions raised by the owners of the newly combined company.

a. What was the value of the shares issued by Speedy Plumbers to acquire Flash Heating Company?

\(b\). What was the fair value of the net assets held by Flash Heating immediately before the combination?

c. How many shares of Speedy Plumbers were issued in completing the combination?

d. What was the market price per share of Speedy Plumbers stock at the date of combination?

\(e\). Was the full retained earnings balance of Flash Heating carried forward in the pooling case? How do you know?

f. What was the book value of the net assets of Flash Heating at combination?

g. Flash Heating uses a LIFO inventory basis. How much did its inventory increase in value between the date purchased and the time of the business combination?

h. What was the balance in working capital reported by Flash Heating before the business combination?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King