On July 1, 20X2, Amalgamated Transport acquired all of the assets and liabilities of the Swamp Island

Question:

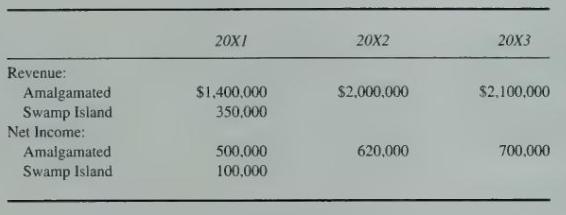

On July 1, 20X2, Amalgamated Transport acquired all of the assets and liabilities of the Swamp Island Railroad by issuing 25,000 common shares. At the date of acquisition, Amalgamated's stock was selling for \(\$ 96\) per share; the net book value of the Swamp Island Railroad on that date was \(\$ 2,200,000\). All the excess of the purchase price over Swamp Island's net book value was attributable to equipment with a life of five years from the date of combination. The following annual results of operations were reported by Amalgamated and Swamp Island prior to the combination and by the combined company subsequent to the combination:

These results of operations reflect the amounts actually reported for each year; the amounts reported for periods subsequent to the combination are based on the combination's having been treated as a pooling of interests.

The revenues and income for both companies have been earned evenly throughout individual years. For the first half of \(20 \mathrm{X} 2\), Amalgamated earned net income of \(\$ 255,000\) on revenue of \(\$ 800,000\); Swamp Island earned \(\$ 55,000\) on revenue of \(\$ 200,000\). There were no intercompany transactions between the two companies at any time. Amalgamated had 100,000 shares of common stock outstanding prior to the combination.

\section*{Required}

Present the amounts that would appear for 20X1, 20X2, and 20X3 in Amalgamated Transport's comparative income statement prepared at the end of its fiscal year on December 31, 20X3, for (1) revenues, (2) net income, and (3) earnings per share assuming the business combination was treated as a:

a. Pooling of interests.

b. Purchase.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King