The adjusted trial balance of Armored Financial Couriers, Inc., at June 30, 19X1, the end of the

Question:

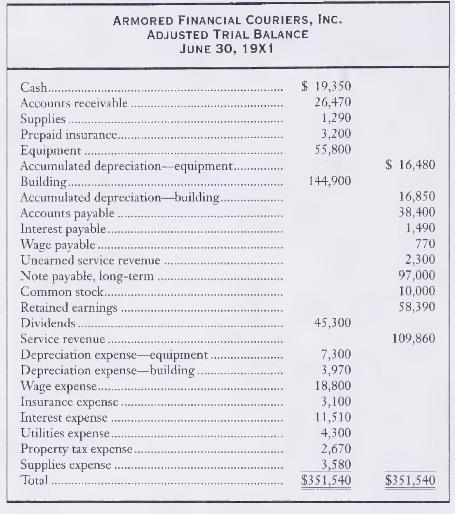

The adjusted trial balance of Armored Financial Couriers, Inc., at June 30, 19X1, the end of the company's fiscal year, follows:

Adjusting data at June 30, 19X1, which have all been incorporated into the trial balance figures above:

a. Depreciation for the year: equipment, \(\$ 7,300\); building, \(\$ 3,970\).

b. Supplies used during the year, \(\$ 3,580\).

c. Prepaid insurance expired during the year, \(\$ 3,100\).

d. Accrued interest expense, \(\$ 690\).

e. Accrued service revenue, \(\$ 940\).

f. Unearned service revenue earned during the year, \(\$ 7,790\).

g. Accrued wage expense, \(\$ 770\).

\section*{Required}

1. Journalize the adjusting and closing entries.

2. Prepare Armored Financial's income statement and statement of retained earnings for the year ended June 30, 19X1, and the classified balance sheet on that date. Use the account format for the balance sheet.

3. Compute Armored Financial's current ratio and debt ratio at June 30, 19X1. One year ago the current ratio stood at 1.01, and the debt ratio was 0.71 . Did Armored Financial's ability to pay debts improve or deteriorate during 19X1?

4. How will what you learned in this problem help you manage a business?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.