On July 1, 20X3, Super Corp. purchased 80% of the common shares and 40% of the preferred

Question:

Common shares, no par (300,000 shares)...........................$3,000,000

Preferred shares, no par (10,000 shares)..............................1,100,000

Other contributed capital...........................................................400,000

Retained earnings....................................................................1,500,000

..................................................................................................$6,000,000

Paltry€™s preferred shares are cumulative and non-participating and carry a dividend rate of $15 per year per share. The dividends are paid at the end of each calendar quarter. The redemption price of the preferred shares is $100 per share. At the time of Super€™s purchase, the Paltry preferred shares were selling on the market at $95.

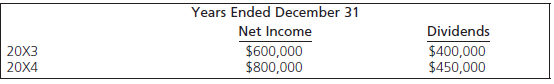

The fair values of Paltry€™s net assets were identical to their carrying values on July 1, 20X3. During 20X3 and 20X4, Paltry€™s net income and dividends declared (common and preferred) were as follows:

All preferred dividends were declared and paid quarterly, as due. Paltry earns its income evenly throughout the year.

Required

a. Determine the amounts at which each of Super€™s investments in the common and preferred shares of Paltry should appear in Super€™s statement of financial position on December 31, 20X3, and on December 31, 20X4, assuming that Super does not consolidate Paltry. Show all calculations clearly.

b. Assume that on January 2, 20X5, Super Corp sells 1,000 of its Paltry preferred shares. Determine the balance remaining in the investment account for the preferred shares after the sale.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay