One of your clients. Sanna Ltd, has prepared a draft set of financial statements and submitted them

Question:

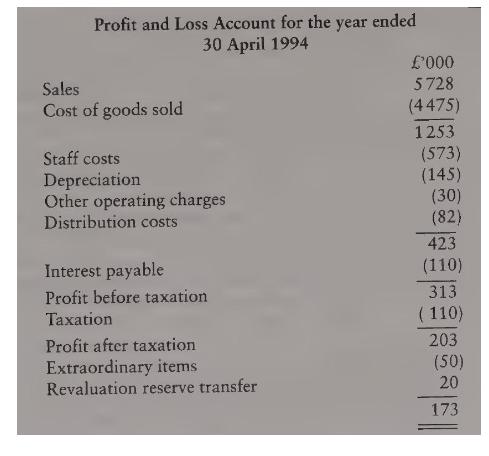

One of your clients. Sanna Ltd, has prepared a draft set of financial statements and submitted them to you for your advice:

(2) Development costs have arisen as a result of developing a product for a major customer. It is considered that the product will be a commercial success and the customer is reimbursing all of Sanna Ltd's costs plus a \(15 \%\) mark-up.

(3) The freehold property was revalued three years ago. The company has been transferring the annual depreciation charged to the profit and loss account from the revaluation reserve to retained earnings as the company believes it is now a realised profit.

(4) Extraordinary items comprise:

The closure of the factory and the related disposal of the factory premises comprised a significant business segment of the company which had contributed 750 000 to turnover and accounted for 15% of the costs charged in arriving at operating profit. The company's rationalisation costs above were necessarily incurred as a result of the closure of the factory.

(5) Staff costs comprise 70% production employees, 20% general and clerical employ- ees and 10% sales and marketing employees. The company sub-contracts all its transport function. (6) Other operating charges relate to losses on disposal of plant and machinery fixed assets.

(7) Depreciation of plant and machinery is 90000 in the year ended 30 April 1994.

(8) As a change in accounting policy, goodwill is to be written off to reserves rather than amortised. The goodwill arose in the year ended 30 April 1993, amounted to 30 000 and had an estimated useful life of three years. No amortisation has been charged in the 1994 draft accounts.

Requirement Prepare the profit and loss account, balance sheet and a reconciliation of movements in shareholders' funds for Sanna Ltd for the year ended 30 April 1994 in accordance with FRS 3, Reporting financial performance, and relevant legislation.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill