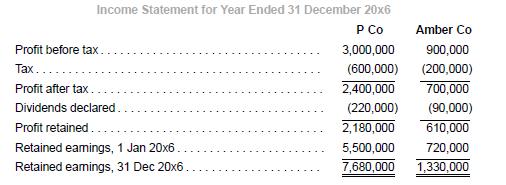

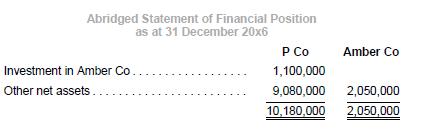

P Co acquired interests in Amber Co. The current financial statements are shown below. All figures are

Question:

P Co acquired interests in Amber Co. The current financial statements are shown below. All figures are in dollars, unless as otherwise indicated.

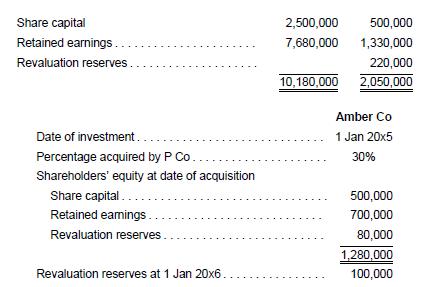

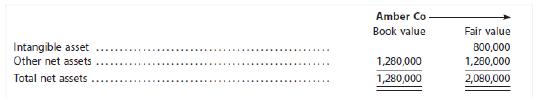

Fair and book values of identifiable net assets of Amber Co at investment date:

Additional information:

1. The intangible asset of Amber Co had remaining useful life of ten years at acquisition date. At the year-end impairment review, the recoverable amount of the intangible asset showed the following recoverable amounts:

2. On 1 July 20x5, P Co transferred fixed assets to Amber Co at a transfer price of $500,000. The original cost of the fixed asset was $520,000 while the net book value was $420,000. The original useful life was five years.

The remaining useful life as at 1 July 20x5 was four years.

3. Apply a tax rate of 20% on all appropriate adjustments. Recognize tax effects on fair value adjustments. Amber Co recognizes impairment losses, if any, at the financial year-end.

Required

1. Prepare equity accounting entries for the year ended 31 December 20x6.

2. Perform an analytical check of the balance of the investment in associate account as at 31 December 20x6.

3. Ignore (1) and (2). P Co applies the equity method to determine the investment in associate in its separate financial statements from date of initial investment.

a. Determine the investment in associate balance as at 31 December 20x5.

b. Prepare the journal entries to apply the equity method in the current year ended 31 December 20x6.

c. Compare the investment balance as at 31 December 20x6 derived from Q3

(a) and Q3

(b) with Q2.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah