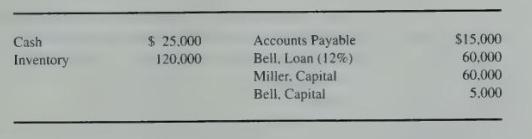

Partners Miller and Bell have decided to liquidate their business. The ledger shows the following account balances:

Question:

Partners Miller and Bell have decided to liquidate their business. The ledger shows the following account balances:

Miller and Bell share profits and losses in a \(8: 2\) ratio. The 12 percent note payable to Bell contains a provision that interest ceases accruing at the date the business terminates as a going concern. During the first month of liquidation, half the inventory is sold for \(\$ 40.000\), and \(\$ 10,000\) of the accounts payable is paid. During the second month, the rest of the inventory is sold for \(\$ 30,000\), and the remaining accounts payable are paid. Cash is distributed at the end of each month, and the liquidation is completed at the end of the second month.

\section*{Required}

Prepare a statement of partnership realization and liquidation with a schedule of safe payments for the two-month liquidation period.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King