Several years ago, Dan and Rob formed the True Lumber Company, a partnership. Last year, they admitted

Question:

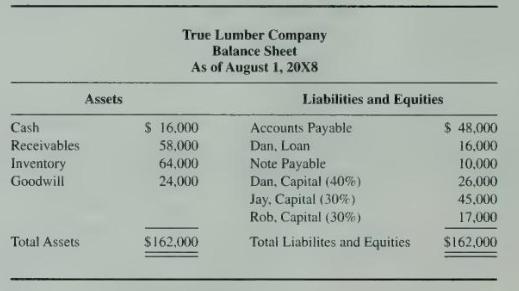

Several years ago, Dan and Rob formed the True Lumber Company, a partnership. Last year, they admitted Jay as a partner and recognized goodwill at that time. However, after failing to gain a sufficient market of continuing customers, they recently agreed to liquidate the business. The balance sheet, with profit and loss sharing percentages just prior to liquidation, is as follows:

The loan from Dan was made to provide working capital for the partnership to operate during the last two months.

During August 20X8, the first month of the liquidation, the partnership collected \(\$ 30,000\) of the receivables and decided to write off \(\$ 12,000\) of the remaining receivables. Sales of one-half of the book value of the inventory realized a gain of \(\$ 6,000\). The partners estimate that the costs of liquidating the business are expected to be \(\$ 4,000\) for the remainder of the liquidation process.

\section*{Required}

Prepare a schedule of safe payments to partners as of August \(31,20 \times 8\), to show how the available cash should be distributed to the partners.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King