Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Companys

Question:

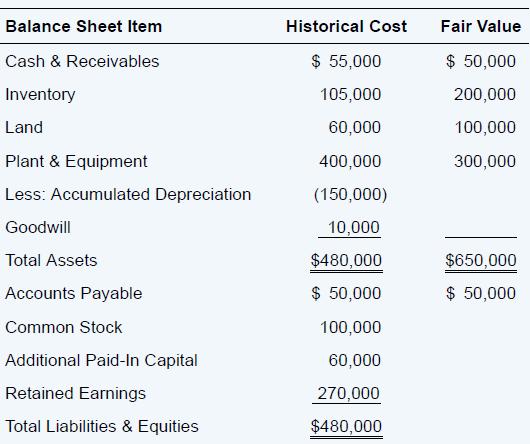

Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Planter was $608,000. The following balance sheet data were reported by Sorden:

Required

Give the journal entry that Planter recorded at the time of exchange.

Transcribed Image Text:

Balance Sheet Item Cash & Receivables Inventory Land Plant & Equipment Less: Accumulated Depreciation Goodwill Total Assets Accounts Payable Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities & Equities Historical Cost $ 55,000 105,000 60,000 400,000 (150,000) 10,000 $480,000 $ 50,000 100,000 60,000 270,000 $480,000 Fair Value $ 50,000 200,000 100,000 300,000 $650,000 $ 50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Journal entry to record acquisition of Sorden Compan...View the full answer

Answered By

Rukhsar Ansari

I am professional Chartered accountant and hold Master degree in commerce. Number crunching is my favorite thing. I have teaching experience of various subjects both online and offline. I am online tutor on various online platform.

5.00+

4+ Reviews

17+ Question Solved

Related Book For

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted:

Students also viewed these Business questions

-

Using the data presented in E113, determine the amount Planter Corporation would record as a gain on bargain purchase and prepare the journal entry Planter would record at the time of the exchange if...

-

Fortune Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Companys net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Fortune...

-

Annapolis Company purchased a $2,000, 7%, 9-year bond at 99 and held it to maturity. The straight line method of amortization is used for both premiums & discounts. What is the net cash received...

-

Discuss the seven contemporary communication issues facing managers.

-

The following scenarios describe situations currently facing companies. For each scenario, indicate whether a standard costing system would be beneficial in that situation or not and explain why or...

-

Explain why cultural factors should be an important consideration in analyzing and choosing among alternative strategies.

-

Im like the quarterback of the team. I manage 250 accounts, and anything from billing issues, to service issues, to selling the products. Im really the face to the customer, says Alison Capossela, a...

-

Ivey Company prepared the following budgeted income statement for the first quarter of 2016: Ivey Company is considering two options. Option 1 is to increase advertising by $ 1,000 per month. Option...

-

2) Loctorism Inc. uses the revaluation model (elimination method) to account for equipment. Upon inception of the company Loctorism purchased equipment for $250,000 on July 1, 2019 (fiscal year end...

-

Shawn and Amy were college sweethearts and had been married for 20 wonderful years. They lived in Denver, Colorado. Shawn was one of three partners with the OMG! Engineering firm. Unfortunately,...

-

Pun Corporation concluded the fair value of Slender Company was $60,000 and paid that amount to acquire its net assets. Slender reported assets with a book value of $55,000 and fair value of $71,000...

-

Phoster Corporation established Skine Company as a wholly owned subsidiary. Phoster reported the following balance sheet amounts immediately before and after it transferred assets and accounts...

-

Devise a new class to describe floating point numbers. The precision of the floating point numbers will be part of the class. The three precisions to be considered are float, double, and long double.

-

460 V rms 3 phase full wave controlled rectifier feeds an inductive load. The supply voltage has a frequency of 50 Hz. If thyristors are considered ideal; a) Draw the voltage on the load when a = 25....

-

The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company Pepper Company Finished goods inventory, beginning $14,000 $17,950 Work in process...

-

On September 22, 2024, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records...

-

A wound DC motor is connected in both a shunt and a series configuration. Assume generic resistance and inductance parameters Ra, Rf, La, Lf, let the field magnetization constant be kf and the...

-

Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS...

-

Refer to the data provided in Exercise 10-9. In Exercise 10-9 Mahn Corporation produces high-quality leather belts. The company uses a standard cost system and has set the following standards for...

-

Determine the values of the given trigonometric functions directly on a calculator. The angles are approximate. tan 0.8035

-

What is the difference between a Chapter 7 bankruptcy and a Chapter 11 bankruptcy?

-

Under the Securities Exchange Act of 1934, entities are required to report to the public about changing auditors on a. Form 10- K. b. Form S- 1. c. Form 10- Q. d. Form 8- K.

-

Refer to the information presented in Exercise 6.27. REQUIRED Prepare a process cost report under the FIFOmethod. Work in process, December 1 Costs added in December Direct Materials $19,200 31,200...

-

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report....

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

Study smarter with the SolutionInn App