Presley Pools Inc. acquired 60 percent of the common stock of Sammy Swim Company on December 31,

Question:

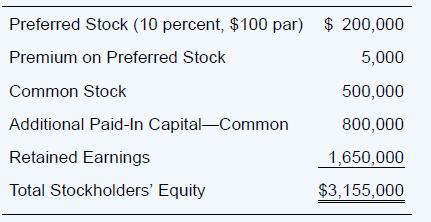

Presley Pools Inc. acquired 60 percent of the common stock of Sammy Swim Company on December 31, 20X6, for $1,800,000. At that date, the fair value of the noncontrolling interest was $1,200,000. The full amount of the differential was assigned to goodwill. On December 31, 20X7, Presley Pools management reviewed the amount attributed to goodwill and concluded an impairment loss of $26,000 should be recognized in 20X7. On January 2, 20X7, Presley purchased 20 percent of the outstanding preferred shares of Sammy for $44,400. In its 20X6 annual report, Sammy reported the following stockholders’ equity balances at the end of the year:

The preferred stock is cumulative and has a liquidation value equal to its call price of $101 per share. Because of cash flow problems, Sammy declared no dividends during 20X6, the first time it had missed a preferred dividend. With the improvement in operations during 20X7, Sammy declared the current stated preferred dividend as well as preferred dividends in arrears; Sammy also declared a common dividend for 20X7 of $10,000. Sammy’s reported net income for 20X7 was $280,000.

Required

a. Compute the amount of the preferred stockholders’ claim on Sammy Swim’s assets on December 31, 20X6.

b. Compute the December 31, 20X6, book value of the Sammy common shares purchased by Presley.

c. Compute the amount of goodwill associated with Presley’s acquisition of Sammy common stock.

d. Compute the amount of income that should be assigned to the noncontrolling interest in the 20X7 consolidated income statement.

e. Compute the amount of income from its subsidiary that Presley should have recorded during 20X7 using the fully adjusted equity method.

f. Compute the total amount that should be reported as noncontrolling interest in the December 31, 20X7, consolidated balance sheet.

g. Present all consolidation entries that should appear in a worksheet to prepare a complete set of 20X7 consolidated financial statements for Presley Pools and its subsidiary.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd