Question

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The

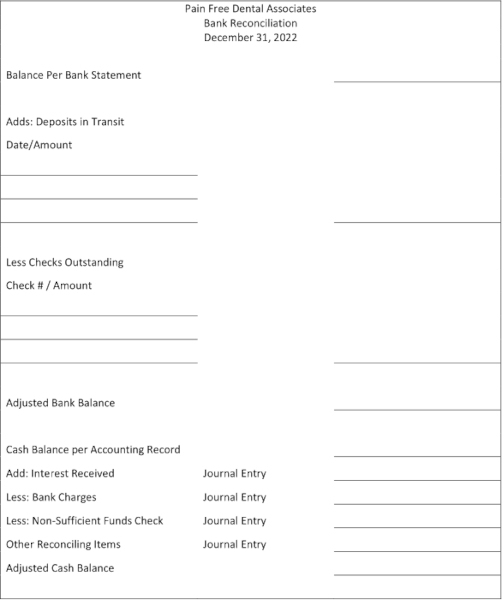

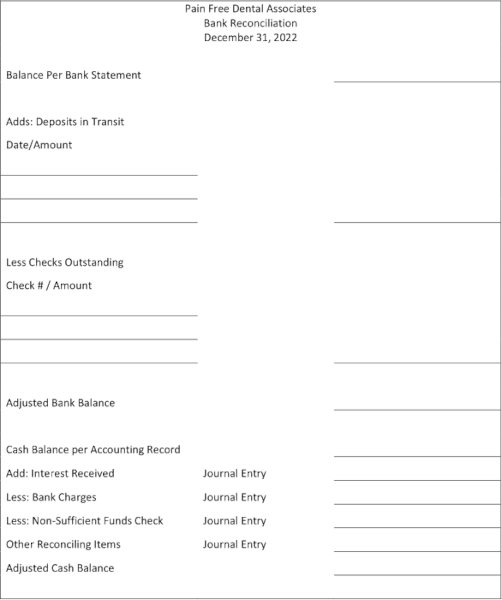

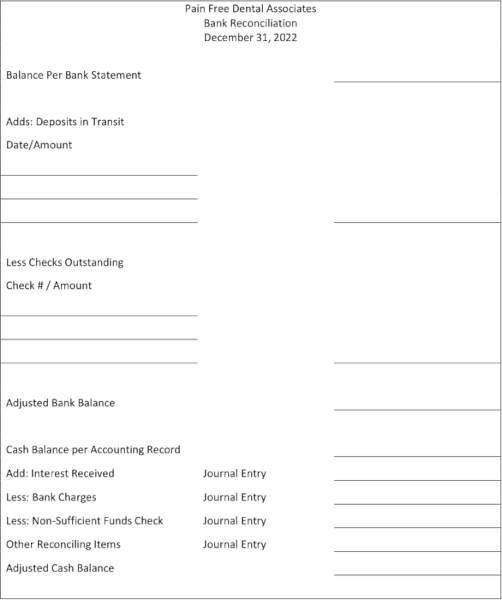

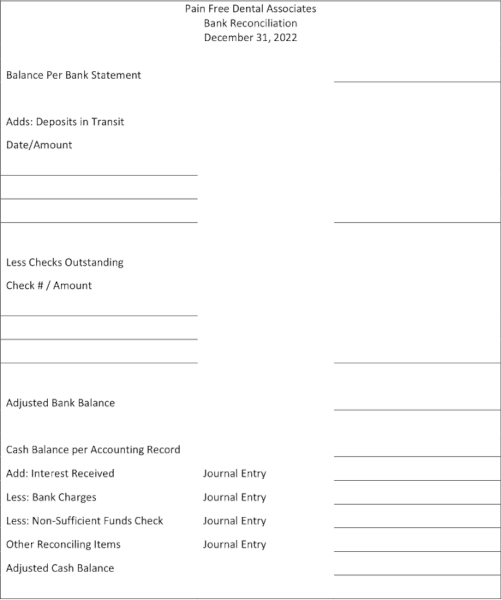

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the adjusted bank balance?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of outstanding checks?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the bank statement balance?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of NSF checks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To prepare the bank reconciliation and determine the adjusted cash balance for Pain Free Dental Associates on December 31 2022 well follow the stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started