Question

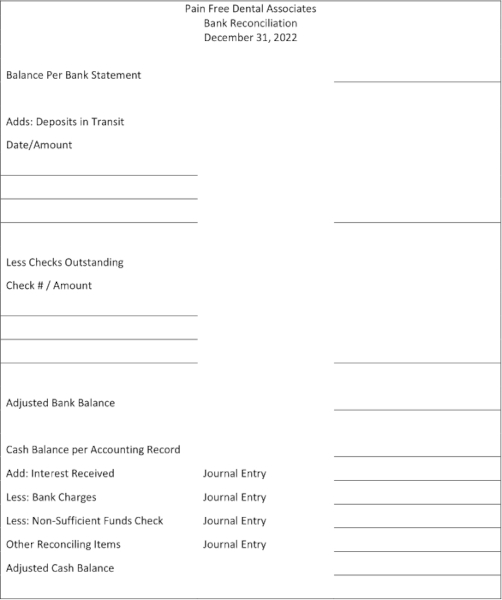

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The

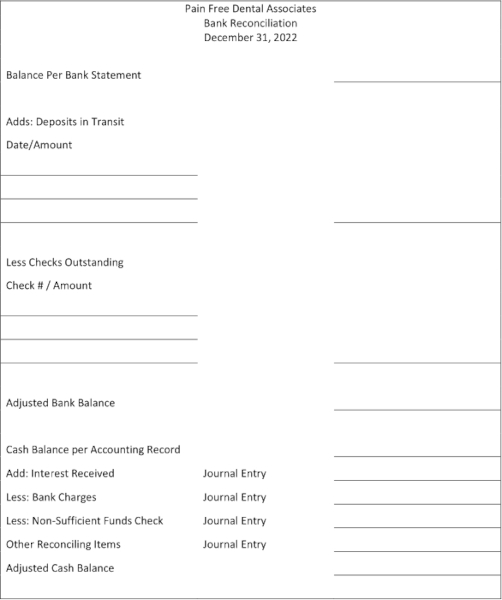

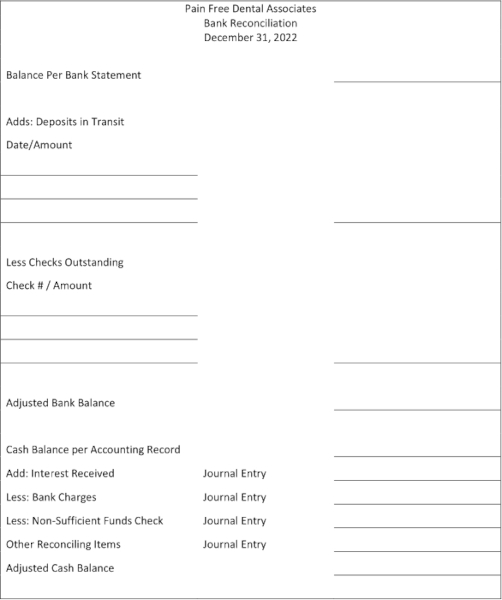

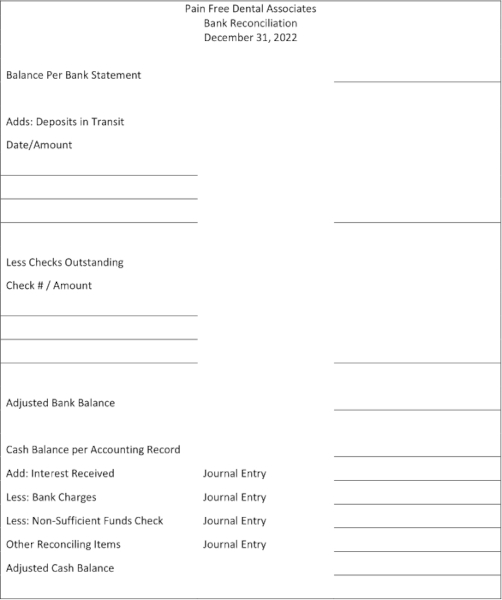

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total bank interest received?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of bank charges?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the total of bank deposit(s) in transit?

Dr. Yong has requested that Senture Houston, an office manager at Pain Free Dental Associates, prepare a single journal entry for December 31, 2022. The bank statement for that day shows $9,500. Three checks were made out on December 30, 2022: $450 for electric, $175 for sterile gloves, and $205 for hand sanitizers. A recent deposit for $5,000 is not on the bank statement. In December, the bank credited $65 in interest to the account and charged bank service fees of $75. Prepare the journal entry to record and complete the bank reconciliation to determine the adjusted cash balance per the facility's accounting records. What is the cash balance per accounting records?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each part of the question and prepare the bank reconciliation and journal entries as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started