Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4. Suppose Garrity continued to use one firm-wide rate based on direct-labor hours to apply all manufacturing costs (except direct materials)

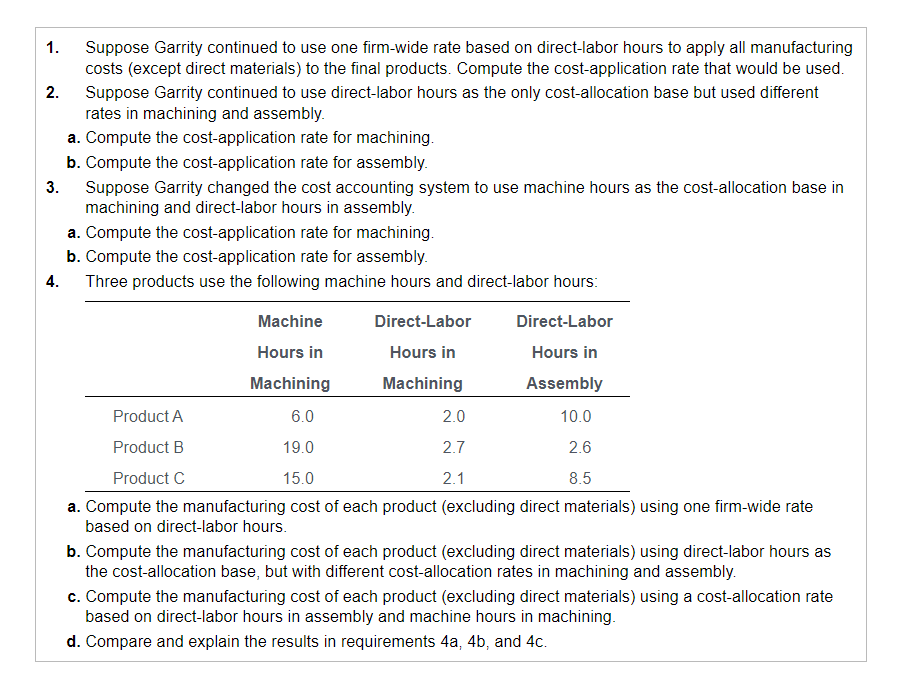

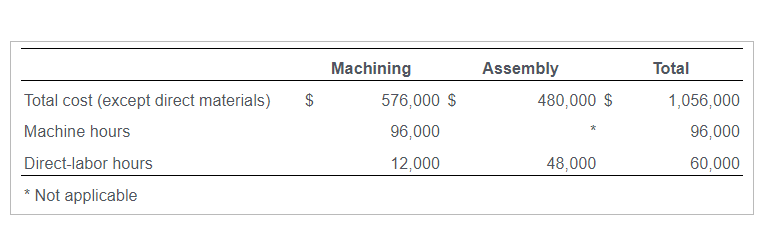

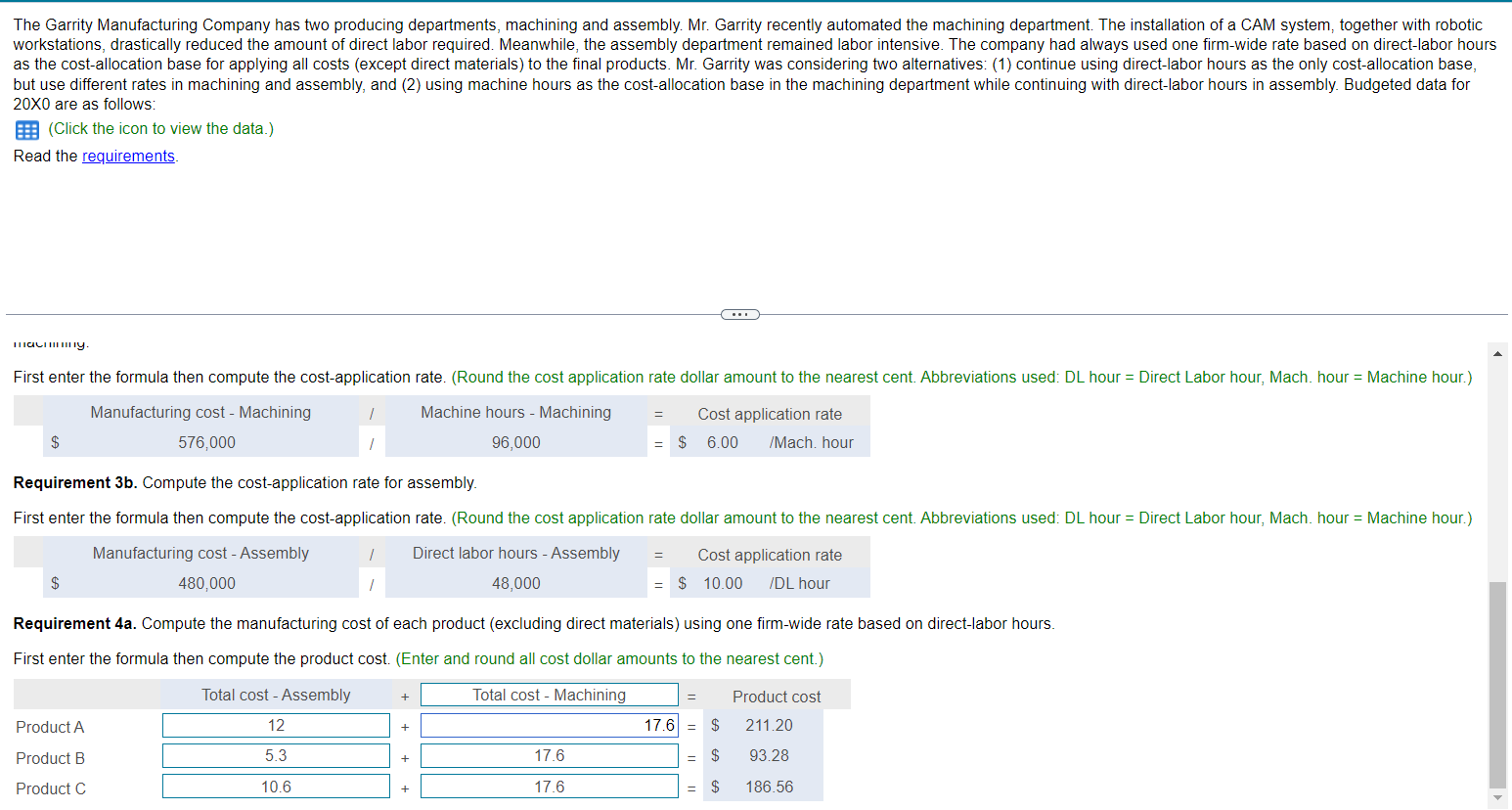

1. 2. 3. 4. Suppose Garrity continued to use one firm-wide rate based on direct-labor hours to apply all manufacturing costs (except direct materials) to the final products. Compute the cost-application rate that would be used. Suppose Garrity continued to use direct-labor hours as the only cost-allocation base but used different rates in machining and assembly. a. Compute the cost-application rate for machining. b. Compute the cost-application rate for assembly. Suppose Garrity changed the cost accounting system to use machine hours as the cost-allocation base in machining and direct-labor hours in assembly. a. Compute the cost-application rate for machining. b. Compute the cost-application rate for assembly. Three products use the following machine hours and direct-labor hours: Machine Hours in Direct-Labor Direct-Labor Hours in Hours in Machining Machining Assembly Product A 6.0 2.0 10.0 Product B 19.0 2.7 2.6 Product C 15.0 2.1 8.5 a. Compute the manufacturing cost of each product (excluding direct materials) using one firm-wide rate based on direct-labor hours. b. Compute the manufacturing cost of each product (excluding direct materials) using direct-labor hours as the cost-allocation base, but with different cost-allocation rates in machining and assembly. c. Compute the manufacturing cost of each product (excluding direct materials) using a cost-allocation rate based on direct-labor hours in assembly and machine hours in machining. d. Compare and explain the results in requirements 4a, 4b, and 4c. Total cost (except direct materials) Machine hours Direct-labor hours Not applicable Machining Assembly Total 576,000 $ 480,000 $ 1,056,000 96,000 96,000 12,000 48,000 60,000 The Garrity Manufacturing Company has two producing departments, machining and assembly. Mr. Garrity recently automated the machining department. The installation of a CAM system, together with robotic workstations, drastically reduced the amount of direct labor required. Meanwhile, the assembly department remained labor intensive. The company had always used one firm-wide rate based on direct-labor hours as the cost-allocation base for applying all costs (except direct materials) to the final products. Mr. Garrity was considering two alternatives: (1) continue using direct-labor hours as the only cost-allocation base, but use different rates in machining and assembly, and (2) using machine hours as the cost-allocation base in the machining department while continuing with direct-labor hours in assembly. Budgeted data for 20X0 are as follows: (Click the icon to view the data.) Read the requirements. machining. First enter the formula then compute the cost-application rate. (Round the cost application rate dollar amount to the nearest cent. Abbreviations used: DL hour = Direct Labor hour, Mach. hour = Machine hour.) Manufacturing cost - Machining Machine hours - Machining 96,000 576,000 Requirement 3b. Compute the cost-application rate for assembly. Cost application rate = $ 6.00 /Mach. hour First enter the formula then compute the cost-application rate. (Round the cost application rate dollar amount to the nearest cent. Abbreviations used: DL hour = Direct Labor hour, Mach. hour = Machine hour.) Manufacturing cost - Assembly Direct labor hours - Assembly Cost application rate 480,000 48,000 = $ 10.00 /DL hour Requirement 4a. Compute the manufacturing cost of each product (excluding direct materials) using one firm-wide rate based on direct-labor hours. First enter the formula then compute the product cost. (Enter and round all cost dollar amounts to the nearest cent.) Total cost - Assembly + Product A 12 Product B 5.3 + Product C 10.6 Total cost - Machining 17.6 = $ Product cost 211.20 93.28 17.6 17.6 186.56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each requirement step by step Requirement 1 Compute the costapplication rate using one firmwide rate based on directlabor hours The total manufacturing cost excluding direct materials ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started