Pumped Up Company purchased equipment from Switzerland for 140,000 francs on December 16, 20X7, with payment due

Question:

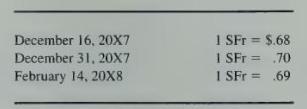

Pumped Up Company purchased equipment from Switzerland for 140,000 francs on December 16, 20X7, with payment due on February 14, 20X8. On December 16, 20X7, Pumped Up also acquired a 60 -day forward contract to purchase francs at a forward rate of \(\mathrm{SFr} 1=\$ .67\). On December 31, 20X7, the forward rate for an exchange on February \(14,20 \mathrm{X} 8\), is SFr \(1=\$ .695\). The spot rates were:

\section*{Required}

a. Prepare journal entries for Pumped Up Company to record the purchase of equipment, all entries associated with the forward contract, the adjusting entries on December 31, 20X7, and entries to record the payment on February 14, 20X8.

b. What was the effect on the income statement of the hedged transaction for the year ended December 31, 20X7?

c. What was the overall effect on the income statement of this transaction from December 16, \(20 \times 7\) to February \(14,20 \times 8\) ?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King