Purchase Corporation purchased 60 percent of Steal Company ownership on January 1, 20X7, for $277,500. Steal reported

Question:

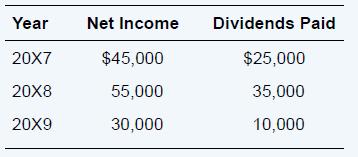

Purchase Corporation purchased 60 percent of Steal Company ownership on January 1, 20X7, for $277,500. Steal reported the following net income and dividend payments:

On January 1, 20X7, Steal had $250,000 of $5 par value common stock outstanding and retained earnings of $150,000, and the fair value of the noncontrolling interest was $185,000. Steal held land with a book value of $22,500 and a market value of $30,000 and equipment with a book value of $320,000 and a market value of $360,000 at the date of combination. The remainder of the differential at acquisition was attributable to an increase in the value of patents, which had a remaining useful life of 10 years. All depreciable assets held by Steal at the date of acquisition had a remaining economic life of eight years.

Required

a. Compute the increase in the fair value of patents held by Steal.

b. Prepare the consolidation entries needed at January 1, 20X7, to prepare a consolidated balance sheet.

c. Compute the balance reported by Purchase as its investment in Steal at December 31, 20X8.

d. Prepare the journal entries recorded by Purchase with regard to its investment in Steal during 20X9.

e. Prepare the consolidation entries needed at December 31, 20X9, to prepare a three-part consolidation worksheet.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd