Refer to P 3-7 in the main chapter. On December 31, 20X6, Profound Limited acquired 100% of

Question:

Refer to P 3-7 in the main chapter.

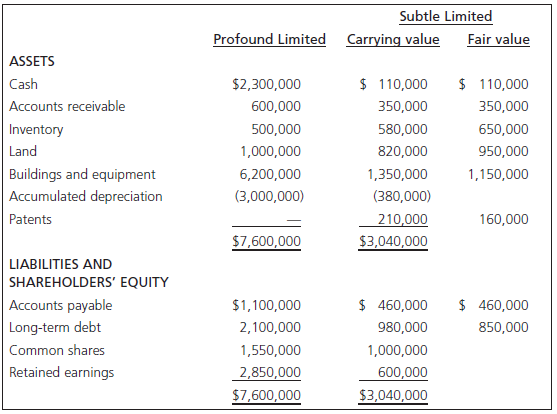

On December 31, 20X6, Profound Limited acquired 100% of the outstanding voting shares of Subtle Limited for $2.2 million in cash. The statements of financial position of Profound and Subtle and the fair values of Subtle's identifiable assets and liabilities immediately before the acquisition transaction were as follows:

Assume that the tax bases of Subtle's assets and liabilities equal their carrying value (i.e., no temporary differences exist between the two, and as such related deferred taxes are zero). Assume that the relevant future tax rate is 25%.

Required

Provide the eliminations and adjustments required at the date of acquisition necessary to prepare the consolidated SFP of Profound Limited on October 1, 20X6. Include in your adjustments the deferred tax adjustment arising from the allocation of the fair value adjustment to the net identifiable assets of Subtle Limited.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay