Refer to the preceding facts for Parsons acquisition of Solar common stock. Parson uses the simple equity

Question:

Refer to the preceding facts for Parson’s acquisition of Solar common stock. Parson uses the simple equity method to account for its investment in Solar. During 2016, Solar sells $30,000 worth of merchandise to Parson. As a result of these intercompany sales, Parson holds beginning inventory of $12,000 and ending inventory of $16,000 of merchandise acquired from Solar. At December 31, 2016, Parson owes Solar $6,000 from merchandise sales. Solar has a gross profit rate of 30%.

On January 1, 2015, Parson sells equipment having a net book value of $50,000 to Solar for $80,000. The equipment has a 5-year useful life and is depreciated using the straight-line method.

Neither company has provided for income tax. The companies qualify as an affiliated group and, thus, will file a consolidated tax return based on a 40% corporate tax rate. The original purchase is not a nontaxable exchange.

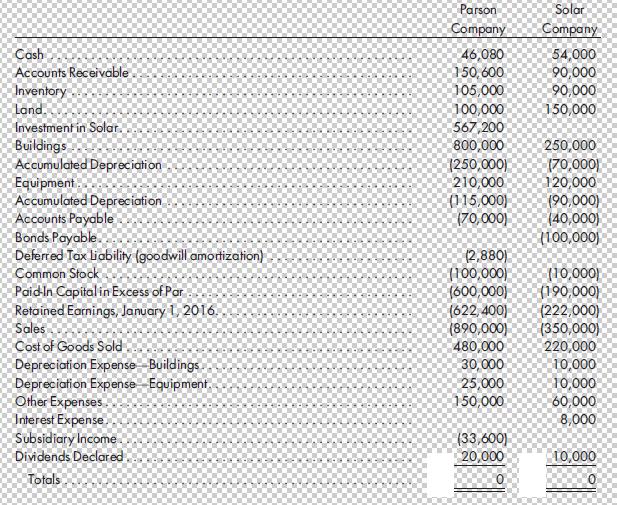

On December 31, 2016, Parson and Solar have the following trial balances:

Required

1. Prepare a determination and distribution of excess schedule.

2. Prepare a consolidated worksheet for the year ended December 31, 2016. Include a provision for income tax and income distribution schedules.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng