Select the best answer for each of the following multiple-choice questions. (Nos. 1, 5, and 710 are

Question:

Select the best answer for each of the following multiple-choice questions. (Nos. 1, 5, and 7–10 are AICPA adapted.)

1. The encumbrances control account of a governmental unit is increased when a voucher payable is

a. not recorded and the budgetary accounts are not closed.

b. not recorded but the budgetary accounts are closed.

c. recorded and the budgetary accounts are closed.

d. recorded but the budgetary accounts are not closed.

2. If not expenditure driven, a grant approved and paid by the federal government to assist in a city's welfare program during the current year should be credited to

a. Revenues.

b. Fund Balance-Reserved for Welfare Programs.

c. Fund Balance-Unassigned.

d. Other Financing Sources.

3. Which one of the following equations will yield the available balance in an expenditure subsidiary ledger account?

a. Appropriations − Expenditures Total

b. Appropriations − Encumbrances Balance

c. Appropriations − Expenditures Total − Encumbrances Balance

d. Appropriations − Expenditures Total + Encumbrances Balance

4. Lacking sufficient cash for operations, a city borrows money from a bank, using as collateral the expected receipts from levied property taxes. Upon receipt of cash from the bank, the general fund would credit

a. Revenues.

b. Other Financing Sources.

c. Tax Anticipation Notes Payable.

d. Taxes Receivable-Delinquent.

5. Elm City issued a purchase order for supplies with an estimated cost of $5,000. When the supplies were received, the accompanying invoice indicated an actual price of $4,950. What amount should Elm debit (credit) to the reserve for encumbrances after the supplies and invoice were received?

a. ($50)

b. $50

c. $4,950

d. $5,000

6. The recorded amount for uncollectible taxes was overstated. To revise the estimate during the same fiscal period, the journal entry would credit

a. Expenditures.

b. Revenues.

c. Allowance for Uncollectible Delinquent Taxes.

d. Fund Balance-Unassigned.

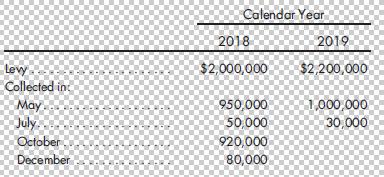

7. Mile-High City's year-end is June 30. Mile-High levies property taxes in January of each year for the calendar year. One-half of the levy is due in May, and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Mile-High's property taxes for the period from July 1, 2018, to June 30, 2019:

The $70,000 balance due for the May 2019 installments was expected to be collected in August 2019. What amount should Mile-High recognize for property tax revenue for the year ended June 30, 2019?

a. $2,100,000

b. $2,200,000

c. $2,360,000

d. $2,400,000

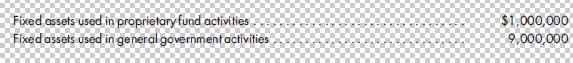

8. Boa City had the following fixed assets:

What aggregate amount should Boa account for in the general fixed assets account group?

a. $9,000,000

b. $10,000,000

c. $10,800,000

d. $11,800,000

9. The following information pertains to Cherry City’s liability for claims and judgments:

What amount should Cherry report for 2018 claims and judgment expenditures?

a. $1,140,000

b. $940,000

c. $840,000

d. $900,000

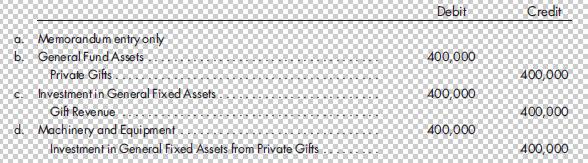

10. Dodd Village received a gift of a new fire engine from a local civic group. The fair value of this fire engine was $400,000. Which of the following is the correct entry to be made in the general fixed assets account group for this gift?

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng