Select the correct answer for each of the following questions. 1. Peel Company received a cash dividend

Question:

Select the correct answer for each of the following questions.

1. Peel Company received a cash dividend from a common stock investment. Should Peel report an increase in the investment account if it uses the cost method or equity method of accounting?

\begin{tabular}{llll}

a. & Nost & & Equity \\

b. Yes & & Yos \\

c. Yes & & No \\

d. No & & Yes

\end{tabular}

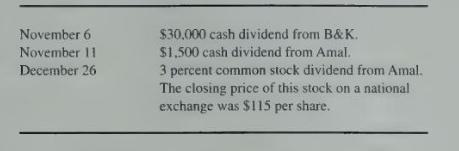

2. In 20X0, Neil Company held the following investments in common stock:

- 25,000 shares of B\&K Inc. 's 100,000 outstanding shares. Neil's level of ownership gives it the ability to exercise significant influence over the financial and operating policies of \(\mathrm{B} \& \mathrm{~K}\).

- 6,000 shares of Amal Corporation's 309,000 outstanding shares.

During 20X0. Neil received the following distributions from its common stock investments:

What amount of dividend revenue should Neil report for 20X0?

a. \(\$ 1,500\).

b. \(\$ 4,200\).

c. \(\$ 31,500\).

d. \(\$ 34,200\).

3. What is the most appropriate basis for recording the acquisition of 40 percent of the stock in another company if the acquisition was a noncash transaction?

a. At the book value of the consideration given.

b. At the par value of the stock acquired.

c. At the book value of the stock acquired.

d. At the fair value of the consideration given.

4. An investor uses the equity method to account for investments in common stock. The purchase price implies a fair value of the investee's depreciable assets in excess of the investee's net asset carrying values. The investor's amortization of the excess:

a. Decreases the investment account.

b. Decreases the goodwill account.

c. Increases the investment revenue account.

d. Does not affect the investment account.

5. A corporation exercises significant influence over an affiliate in which it holds a 40 percent common stock interest. If its affiliate completed a fiscal year profitably but paid no dividends. how would this affect the investor corporation?

a. Result in an increased current ratio.

b. Result in increased earnings per share.

c. Increase several turnover ratios.

d. Decrease book value per share.

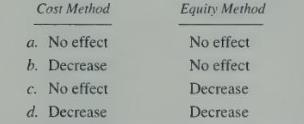

6. An investor in common stock received dividends in excess of the investor's share of investee's earnings subsequent to the date of the investment. How will the investor's investment account be affected by those dividends under each of the following methods?

7. An investor uses the cost method to account for an investment in common stock. A portion of the dividends received this year was in excess of the investor's share of investee's earnings subsequent to the date of investment. The amount of dividend revenue that should be reported in the investor's income statement for this year would be:

a. Zero.

b. The total amount of dividends received this year.

c. The portion of the dividends received this year that was in excess of the investor's share of investee's earnings subsequent to the date of investment.

d. The portion of the dividends received this year that was not in excess of the investor's share of investee's earnings subsequent to the date of investment.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King