Select the correct answer for each of the following questions. 1. Green Corporation owns 30 percent of

Question:

Select the correct answer for each of the following questions.

1. Green Corporation owns 30 percent of the outstanding common stock and 100 percent of the outstanding noncumulative nonvoting preferred stock of Axel Corporation. In 20X1, Axel declared dividends of \(\$ 100,000\) on its common stock and \(\$ 60,000\) on its preferred stock. Green exercises significant influence over Axel's operations. What amount of dividend revenue should Green report in its income statement for the year ended December 31, 20X1?

a. \(\$ 0\).

b. \(\$ 30.000\).

c. \(\$ 60,000\).

d. \(\$ 90.000\).

2. On January 2, 20X3. Kean Company purchased 30 percent interest in Pod Company for \(\$ 250,000\). On this date, Pod's stockholders' equity was \(\$ 500,000\). The carrying amounts of Pod's identifiable net assets approximated their fair values, except for equipment whose fair value exceeded its carrying amount by \(\$ 200,000\) and had an expected remaining useful life of 15 years at January 2, 20X3. Pod reported net income of \(\$ 100,000\) for 20X3, and paid no dividends. Kean accounts for this investment using the equity method. In its December 31, 20X3, balance sheet, what amount should Kean report as its investment in Pod Company?

a. \(\$ 210,000\).

b. \(\$ 220,000\).

c. \(\$ 270,000\).

d. \(\$ 276,000\).

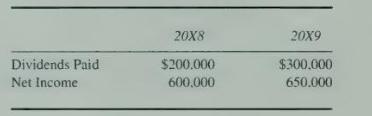

3. On January 1, 20X8. Mega Corporation acquired 10 percent of the outstanding voting stock of Penny Inc. On January 2, 20X9, Mega gained the ability to exercise significant influence over financial and operating control of Penny by acquiring an additional 20 percent of Penny's outstanding stock. The two purchases were made at prices proportionate to the value assigned to Penny's net assets, which equaled their carrying amounts. For the years ended December 31, 20X8 and 20X9. Penny reported the following:

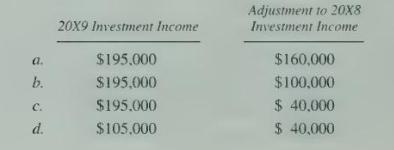

In 20X9, what amounts should Mega report as current year investment income and as an adjustment, before income taxes, to 20X8 investment income?

4. Investor Inc. owns 40 percent of Alimand Corporation. During the calendar year 20X5, Alimand had net earnings of \(\$ 100,000\) and paid dividends of \(\$ 10,000\). Investor mistakenly recorded these transactions using the cost method rather than the equity method of accounting. What effect would this have on the investment account, net earnings, and retained earnings, respectively?

a. Understate, overstate, overstate.

b. Overstate, understate, understate.

c. Overstate, overstate, overstate.

d. Understate, understate, understate.

5. A corporation using the equity method of accounting for its investment in a 40 percent-owned investee, which earned \(\$ 20,000\) and paid \(\$ 5,000\) in dividends, made the following entries:

What effect will these entries have on the investor's statement of financial position?

a. Financial position will be fairly stated.

b. Investment in the investee will be overstated, retained earnings understated.

c. Investment in the investee will be understated, retained earnings understated.

d. Investment in the investee will be overstated, retained earnings overstated.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King