Select the correct answer for each of the following questions. 1. Beni Corporation purchased 100 percent of

Question:

Select the correct answer for each of the following questions.

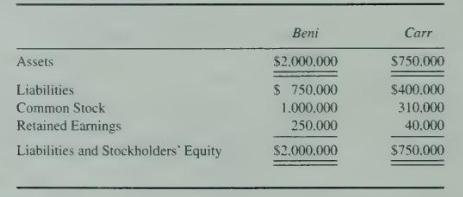

1. Beni Corporation purchased 100 percent of Carr Corporation's outstanding capital stock for \(\$ 430,000\) cash. Immediately before the purchase, the balance sheets of both corporations reported the following:

At the date of purchase, the fair value of Carr's assets was \(\$ 50.000\) more than the aggregate carrying amounts. In the consolidated balance sheet prepared immediately after the purchase, the consolidated stockholders' equity should amount to:

a. \(\$ 1,680,000\).

b. \(\$ 1,650,000\).

c. \(\$ 1,600,000\).

d. \(\$ 1,250,000\).

Items 2 and 3 are based on the following information:

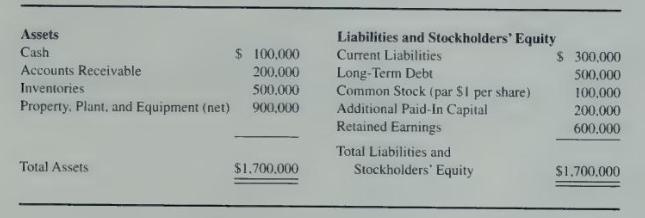

The Nugget Company's balance sheet on December 31, 20X6, is as follows:

On December 31, 20X6, the Gold Company purchased all the outstanding common stock of Nugget for \(\$ 1,500,000\) cash. On that date, the fair (market) value of Nugget's inventories was \(\$ 450,000\), and the fair value of Nugget's property, plant, and equipment was \(\$ 1,000,000\). The fair values of all other assets and liabilities of Nugget were equal to their book values.

2. As a result of the acquisition of Nugget by Gold, the consolidated balance sheet of Gold and Nugget should reflect goodwill in the amount of:

a. \(\$ 500,000\).

b. \(\$ 550,000\).

c. \(\$ 600,000\).

d. \(\$ 650,000\).

3. Assuming that the balance sheet of Gold (unconsolidated) on December 31, 20X6, reflected retained earnings of \(\$ 2,000,000\), what amount of retained earnings should be shown in the December 31, 20X6, consolidated balance sheet of Gold and its new subsidiary, Nugget?

a. \(\$ 2,000,000\).

b. \(\$ 2,600,000\).

c. \(\$ 2,800,000\).

d. \(\$ 3,150,000\).

Items 4 and 5 are based on the following information:

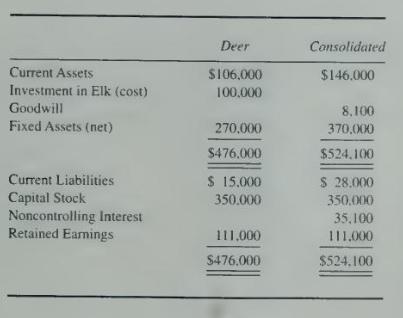

Deer Company acquired 70 percent of the outstanding stock of Elk Corporation. The separate balance sheet of Deer immediately after the acquisition and the consolidated balance sheet are as follows:

Ten thousand dollars of the excess payment for the investment in Elk was ascribed to undervaluation of its fixed assets; the balance of the excess payment was ascribed to goodwill. Current assets of Elk included a \(\$ 2,000\) receivable from Deer that arose before they became related on an ownership basis.

The following two items relate to Elk's separate balance sheet prepared at the time Deer acquired its 70 percent interest in Elk.

4. What was the total of the current assets on Elk's separate balance sheet at the time Deer acquired its 70 percent interest?

a. \(\$ 38,000\).

b. \(\$ 40,000\).

c. \(\$ 42,000\).

d. \(\$ 104,000\).

5. What was the total stockholders' equity on Elk's separate balance sheet at the time Deer acquired its 70 percent interest?

a. \(\$ 64,900\).

b. \(\$ 70,000\).

c. \(\$ 100,000\).

d. \(\$ 117,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King