Select the correct answer for each of the following questions. 1. The primary focus in accounting and

Question:

Select the correct answer for each of the following questions.

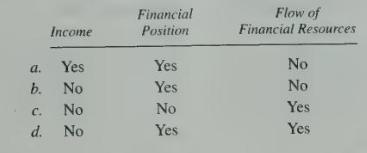

1. The primary focus in accounting and reporting for governmental funds is on:

a. Income determination.

b. Flow of financial resources.

c. Capital maintenance.

d. Transfers relating to proprietary activities.

2. The governmental fund measurement focus is on the determination of:

3. A Budgetary Fund Balance Reserved for Encumbrances in excess of a balance of Encumbrances Control indicates:

a. An excess of vouchers payable over encumbrances.

b. An excess of purchase orders over invoices received.

c. A recording error.

d. An excess of appropriations over encumbrances.

4. The Encumbrances Control account of a governmental unit is debited when:

a. Goods are received.

b. A voucher payable is recorded.

c. A purchase order is approved.

d. The budget is recorded.

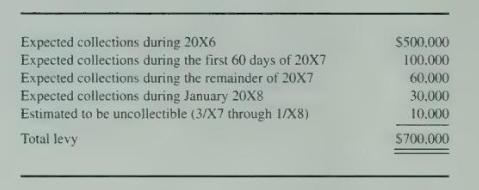

5. The following pertains to property taxes levied by Cedar City for the calendar year 20X6:

What amount should Cedar report for 20X6 for revenues from property taxes?

a. \(\$ 700,000\).

b. \(\$ 600,000\).

c. \(\$ 690,000\).

d. \(\$ 500.000\).

6. Oak City issued a purchase order for supplies with an estimated cost of \(\$ 5.000\). When the supplies were received, the accompanying invoice indicated an actual price of \(\$ 4,950\). What amount should Oak debit (credit) to Budgetary Fund Balance Reserved for Encumbrances after the supplies and invoice were received?

a. \(\$ 5.000\).

b. \(\$(50)\).

c. \(\$ 4.950\)

d. \(\$ 50\).

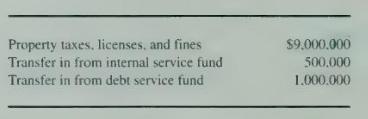

7. For the budgetary year ending December 31. 20X6, Johnson City's general fund expects the following inflows of resources:

In the budgetary entry, what amount should Johnson record for estimated revenues?

a. \(\$ 9,000.000\).

b. \(\$ 9.500 .000\)

c. \(\$ 10.500 .000\).

d. \(\$ 10,000,000\).

8. Encumbrances outstanding at year-end in a state's general fund should be reported as a:

a. Liability in the general fund.

b. Fund balance designation in the general fund.

c. Fund balance reserve in the general fund.

d. Liability in the general long-term debt account group.

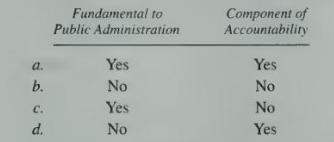

9. Interperiod equity is an objective of financial reporting for governmental entities. According to the Governmental Accounting Standards Board, is interperiod equity fundamental to public administration, and is it a component of accountability?

10. Which of the following statements is correct regarding comparability of governmental financial reports?

a. Comparability is not relevant in governmental financial reporting.

b. Differences between financial reports should be due to substantive differences in underlying transactions or the governmental structure.

c. Selection of different alternatives in accounting procedures or practices account for the differences between financial reports.

d. Similarly designated governments perform the same functions.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King