Select the correct answer for each of the following questions. 1. On January 2, 20X2, a nonprofit

Question:

Select the correct answer for each of the following questions.

1. On January 2, 20X2, a nonprofit botanical society received a gift of an exhaustible fixed asset with an estimated useful life of 10 years and no salvage value. The donor's cost of this asset was \(\$ 20,000\), and its fair market value at the date of the gift was \(\$ 30,000\). What amount of depreciation of this asset should the society recognize in its \(20 \times 2\) financial statements?

a. \(\$ 3,000\).

b. \(\$ 2,500\).

c. \(\$ 2,000\).

d. \(\$ 0\).

2. In 20X1, a nonprofit trade association enrolled five new member companies, each of which was obligated to pay nonrefundable initiation fees of \(\$ 1,000\). These fees were receivable by the association in 20X1. Three of the new members paid the initiation fees in 20X1, and the other two new members paid their initiation fees in \(20 \mathrm{X} 2\). Annual dues (excluding initiation fees) received by the association from all of its members have always covered the organization's costs of services provided to its members. It can be reasonably expected that future dues will cover all costs of the organization's future services to members. Average membership duration is 10 years because of mergers, attrition, and economic factors. What amount of initiation fees from these five new members should the association recognize as revenue in 20X1?

a. \(\$ 5,000\).

b. \(\$ 3.000\).

c. \(\$ 500\).

d. \(\$ 0\).

3. Roberts Foundation received a nonexpendable endowment of \(\$ 500,000\) in \(20 \times 3\) from Multi Enterprises. The endowment assets were invested in publicly traded securities. Multi did not specify how gains and losses from dispositions of endowment assets were to be treated. No restrictions were placed on the use of dividends received and interest earned on fund resources. In 20X4, Roberts realized gains of \(\$ 50,000\) on sales of fund investments, and received total interest and dividends of \(\$ 40.000\) on fund securities. The amount of these capital gains, interest. and dividends available for expenditure by Roberts's unrestricted current fund is:

a. \(\$ 0\).

b. \(\$ 40,000\).

c. \(\$ 50.000\).

d. \(\$ 90,000\).

4. In July \(20 \times 2\). Ross donated \(\$ 200.000\) cash to a church with the stipulation that the revenue generated from this gift be paid to him during his lifetime. The conditions of this donation are that after Ross dies, the principal may be used by the church for any purpose voted on by the church elders. The church received interest of \(\$ 16,000\) on the \(\$ 200,000\) for the year ended June 30, 20×3, and the interest was remitted to Ross. In the church's June 30, 20X3, annual financial statements: \(\square\)

a. \(\$ 200.000\) should be reported as temporarily restricted net assets in the balance sheet.

b. \(\$ 184.000\) should be reported as revenue in the activity statement.

c. \(\$ 216,000\) should be reported as revenue in the activity statement.

d. Both \(a\) and \(c\).

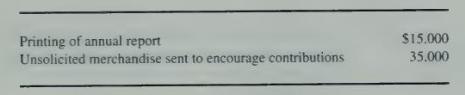

5. The following expenditures were among those incurred by a nonprofit botanical society during 20X4:

What amount should be classified as fund-raising costs in the society's activity statement?

a. \(\$ 0\).

b. \(\$ 5.000\).

c. \(\$ 35.000\).

d. \(\$ 40.000\).

6. Trees Forever, a community foundation, incurred \(\$ 5,000\) in expenses during \(20 \times 3\) putting on its annual talent fund-raising show. In the statement of activities of Trees Forever, the \(\$ 5.000\) should be reported as:

a. A contra asset account.

b. A contra revenue account.

c. A reduction of fund-raising costs.

d. As part of fund-raising costs.

7. In \(20 \times 3\), the board of trustees of Burr Foundation designated \(\$ 100,000\) from its current funds for college scholarships. Also in \(20 \times 3\), the foundation received a bequest of \(\$ 200,000\) from an estate of a benefactor who specified that the bequest was to be used for hiring teachers to tutor handicapped students. What amount should be accounted for as temporarily restricted funds?

a. So.

b. \(\$ 100,000\).

c. \(\$ 200,000\).

d. \(\$ 300,000\).

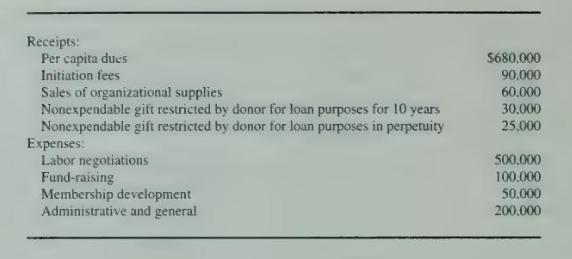

Items 8 through 10 are based on the following information:

United Together, a labor union, had the following receipts and expenses for the year ended December 31. 20X2:

The union's constitution provides that 10 percent of the per capita dues are designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

8. In United Together's statement of activities for the year ended December 31, 20X2, what amount should be reported under the classification of revenue from unrestricted funds?

a. \(\$ 740.000\).

b. \(\$ 762.000\).

c. \(\$ 770,000\).

d. \(\$ 830.000\).

9. In United Together's statement of activities for the year ended December 31, 20X2, what amount should be reported under the classification of program services?

a. \(\$ 500,000\).

b. \(\$ 550,000\).

c. \(\$ 600,000\).

d. \(\$ 850,000\).

10. In United Together's statement of activities for the year ended December 31, 20X2, what amounts should be reported under the classifications of temporarily and permanently restricted net assets?

a. \(\$ 0\) and \(\$ 55.000\), respectively.

b. \(\$ 55,000\) and \(\$ 0\), respectively.

c. \(\$ 30,000\) and \(\$ 25,000\), respectively.

d. \(\$ 25.000\) and \(\$ 30,000\), respectively.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King