Answered step by step

Verified Expert Solution

Question

1 Approved Answer

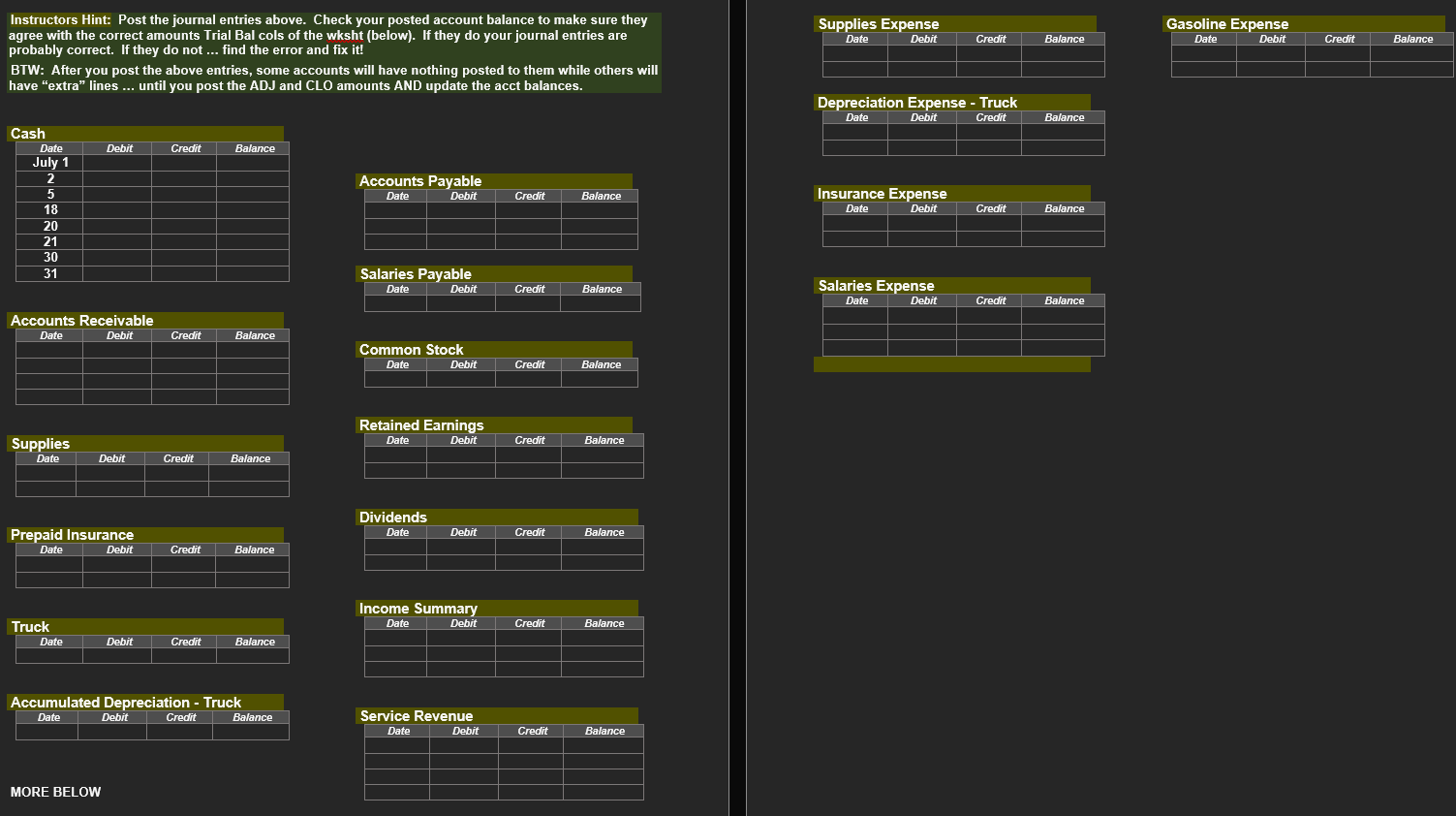

Comprehensive Problem ( Problem info and working papers ) Instructors Hint: Post the journal entries above. Check your posted account balance to make sure they

Comprehensive Problem Problem info and working papersInstructors Hint: Post the journal entries above. Check your posted account balance to make sure they

agree with the correct amounts Trial Bal cols of the wksht below If they do your journal entries are

probably correct. If they do not find the error and fix it

BTW: After you post the above entries, some accounts will have nothing posted to them while others will

have "extra" lines until you post the ADJ and CLO amounts AND update the acct balances.

Accounts Receivable

Supplies

Prepaid Insurance

Truck

Accumulated Depreciation Truck

MORE BELOW

Depreciation Expense Truck

Salaries Payable

Date Debit

Common Stock

Dividends

Income Summary

Salaries Expense

Bob opened Bobs Cleaning Services on July During July the company completed these transactions.

July Bob invested $ cash in the business

Purchased used truck for $ paying $ cash and the balance on account.

Purchased cleaning supplies for $ on account.

Paid $ cash on oneyear insurance policy effective July

Billed customers for $ for cleaning services.

Paid $ of amount owed on truck AND $ of the amount owed on cleaning supplies.

Paid $ for employee salaries.

Collected $ from customers previously billed on July

Billed customers $ for cleaning services.

Paid gasoline for the month on the truck, $

Declared and paid a $ cash dividend.

Use this Chart of Accounts: Cash; Account Receivable; Supplies; Prepaid Insurance; Truck; Accumulated DepreciationTruck; Accounts Payable; Salaries Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue; Supplies Expense; Gasoline Expense; Depreciation Expense; Insurance Expense; Salaries Expense.

Instructions:

a Journalize AND Post the July transactions.

b Prepare a TB Trial Balance at July on a worksheet Completed for you!

Hint verify that YOUR posting $ amounts add up to this correct TB if your numbers

dont match the TB FIX your journal entries and then post and recheck

c Enter the following adjustments, AND total the ADJ columns, on the worksheet.

c Unbilled and uncollected revenues for services performed at July were $

c Depreciation on the Truck for the month was $

c One month July of the year insurance policy was used up

c An inventory count shows that $ of cleaning supplies remains unused as of July

c Accrued, but unpaid, employee salaries were $

d Complete, including column totals, the INC ST and BAL SHT columns of the worksheet.

e Prepare the Income Statement and a Classified Balance Sheet.

f Journalize AND POST the Adjusting entries.

g Journalize AND POST the Closing entries.

h Prepare a PostClosing Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started