Answered step by step

Verified Expert Solution

Question

1 Approved Answer

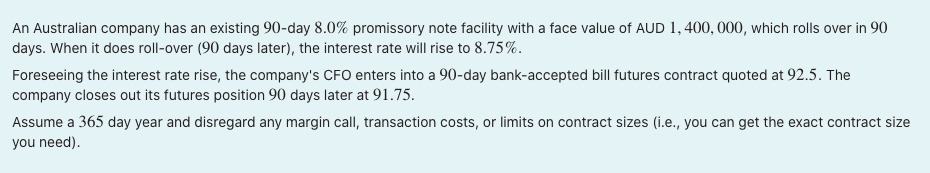

An Australian company has an existing 90-day 8.0% promissory note facility with a face value of AUD 1,400,000, which rolls over in 90 days.

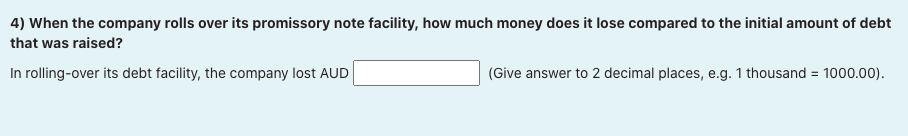

An Australian company has an existing 90-day 8.0% promissory note facility with a face value of AUD 1,400,000, which rolls over in 90 days. When it does roll-over (90 days later), the interest rate will rise to 8.75%. Foreseeing the interest rate rise, the company's CFO enters into a 90-day bank-accepted bill futures contract quoted at 92.5. The company closes out its futures position 90 days later at 91.75. Assume a 365 day year and disregard any margin call, transaction costs, or limits on contract sizes (i.e., you can get the exact contract size you need). 4) When the company rolls over its promissory note facility, how much money does it lose compared to the initial amount of debt that was raised? In rolling-over its debt facility, the company lost AUD (Give answer to 2 decimal places, e.g. 1 thousand = 1000.00).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Promissory Note Facility This company has in place a preexisting AUD 1400000 80 promissory note facility having a face value and maturing in 90 days ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started