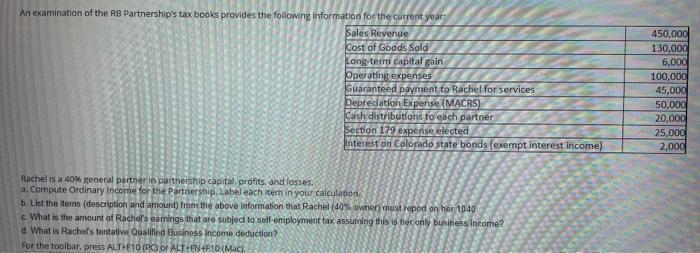

An examination of the RB Partnership's tax books provides the following information for the current year Sales Revenue Cost of Goods Sold 450,000 130,000

An examination of the RB Partnership's tax books provides the following information for the current year Sales Revenue Cost of Goods Sold 450,000 130,000 Long-term capital gain Operating expenses 6,000 100,000 Guaranteed payment to Rachel for services 45,000 Depreciation Expense (MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected, 25,000 Interest on Colorado state bonds (exempt interest income) 2,000 Rachel is a 40% general partner in partnership capital, profits, and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040 What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business income? d. What is Rachel's tentative Qualified Business Income deduction? For the toolbar, press ALT+E10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Overview Rachel is a 40 general partner in RB Partnership and we need to compute the Ordinary Income items Rachel must report on her 1040 her earnings subject to selfemployment tax and her tentative Q... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards