Select the correct answer for each of the following questions: 1. On January 1, 20X1. Kalb Company

Question:

Select the correct answer for each of the following questions:

1. On January 1, 20X1. Kalb Company purchased at par 500 of the \(\$ 1,000\) face value, 8 percent bonds of Lane Corporation as a long-term investment. The bonds mature on January 1, 20X9, and pay interest semiannually on July 1 and January 1. Lane incurred heavy losses from operations for several years and defaulted on the July 1, 20X4, and January 1, 20X5, interest payments. Because of the permanent decline in market value of Lane's bonds, Kalb wrote down its investment to \(\$ 400,000\) on December 31, 20X4. Pursuant to Lane's plan of reorganization effected on January 1, 20X5, Kalb received 5,000 shares of \(\$ 100\) par value, 8 percent cumulative preferred stock of Lane in exchange for the \(\$ 500,000\) face value bond investment. The quoted market value of the preferred stock was \(\$ 70\) per share on January 1, 20X5. What amount of loss should be included in the determination of Kalb's net income for 20X5?

a. \(\$ 0\).

b. \(\$ 50,000\).

c. \(\$ 100,000\).

d. \(\$ 150,000\)

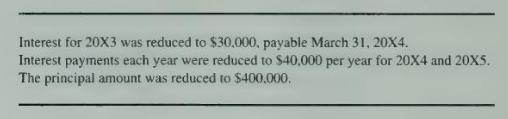

2. Carling Inc. is indebted to Dow Finance Company under a \(\$ 600,000,10\) percent, five-year note dated January 1, 20X1. Interest, payable annually on December 31, was paid on the December \(31,20 \mathrm{X} 1\) and \(20 \mathrm{X} 2\), due dates. However, during 20X3, Carling experienced severe financial difficulties and is likely to default on the note and interest unless some concessions are made. On December 31, 20X3, Carling and Dow signed an agreement restructuring the debt as follows:

What is the amount of gain that Carling should report on the debt restructuring in its income statement for the year ended December 31, 20X3?

a. \(\$ 120,000\).

b. \(\$ 150,000\).

c. \(\$ 200,000\).

d. \(\$ 230.000\).

3. For a troubled debt restructuring involving only modification of terms, it is appropriate for a debtor to recognize a gain when the carrying amount of the debt:

a. Exceeds the total future cash payments specified by the new terms.

b. Is less than the total future cash payments specified by the new terms.

c. Exceeds the present value specified by the new terms.

d. Is less than the present value specified by the new terms.

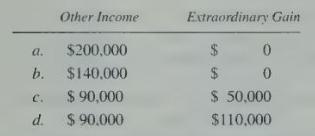

4. Hull Company is indebted to Apex under a \(\$ 500,000,12\) percent, three-year note dated December 31, 20X1. Because of Hull's financial difficulties developing in 20X3, Hull owed accrued interest of \(\$ 60,000\) on the note at December 31, 20X3. Under a troubled debt restructuring, on December 31, 20X3, Apex agreed to settle the note and accrued interest for a tract of land having a fair value of \(\$ 450,000\). Hull's acquisition cost of the land is \(\$ 360,000\). Ignoring income taxes, on its \(20 \times 3\) income statement Hull should report as a result of the troubled debt restructuring:

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King