Shott, a public limited company, set up a wholly owned foreign subsidiary company, Hammer, on 1 June

Question:

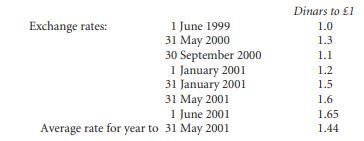

Shott, a public limited company, set up a wholly owned foreign subsidiary company, Hammer, on 1 June 1999 with a share capital of 400 000 ordinary shares of 1 dinar. Shott transacts on a limited basis with Hammer. It maintains a current account with the company but very few transactions are processed through this account. Shott is a multinational company with net assets of £1500 million and ‘normal’ profits are approximately £160 million. The management of Hammer are all based locally although Shott does have a representative on the management board. The prices of the products of Hammer are determined locally and 90% of sales are to local companies. Most of the finance required by Hammer is raised locally, although occasionally short term finance is raised through borrowing monies from Shott. Hammer has made profits of 80 000 dinars and 120 000 dinars after dividend payments respectively for the two years to 31 May 2001. During the financial year to 31 May 2001, the following transactions took place:

(i) On 30 September 2000, a dividend from Hammer of 0.15 dinars per share was declared. The dividend was received on 1 January 2001 by Shott.

(ii) Hammer sold goods of 24 000 dinars to Shott during the year. Hammer made 25%

profit on the cost of the goods. The goods were ordered by Shott on 30 September 2000, were shipped free on board (fob) on 1 January 2001, and were received by Shott on 31 January 2001. Shott paid the dinar amount on 31 May 2001 and had not hedged the transaction. All the goods remain unsold as at 31 May 2001.

(iii) Hammer has borrowed 150 000 dinars on 31 January 2001 from Shott in order to alleviate its working capital problems. At 31 May 2001 Hammer’s financial statements showed the amount as owing to Shott. The loan is to be treated as permanent and is designated in pounds sterling.

The directors of Shott wish to use the closing rate to translate the balance sheet of Hammer and the average rate to translate the profit and loss account of Hammer but are unsure as to whether this is possible under accounting standards. On 1 June 2001 Hammer was sold for 825000 dinars, and the proceeds were received on that day.

Required

(a) (i) Advise Shott as to whether the temporal or closing rateet investment method should be used to translate the financial statements of Hammer; (6 marks)

(ii) Discuss the claim by SSAP 20 Foreign Currency Translation, that the usage of the temporal or net investment/closing rate method is based upon the economic relationship between the holding company and its foreign subsidiary. (5 marks)

(b) Discuss how the above transactions should be dealt with in the consolidated financial statements of Shott, calculating the gain or loss on the disposal of Hammer on 1 June 2001 and stating how the cumulative exchange differences would be dealt with on the disposal. (14 marks)

ACCA, Financial Reporting Environment (UK Stream), June 2001 (25 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey