Solo Co. Ltd., located in Mexico City, is a wholly owned subsidiary of Partner Inc., a U.S.

Question:

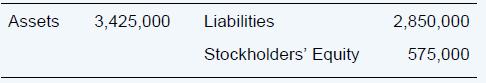

Solo Co. Ltd., located in Mexico City, is a wholly owned subsidiary of Partner Inc., a U.S. company. At the beginning of the year, Solo’s condensed balance sheet was reported in Mexican pesos (MXP) as follows:

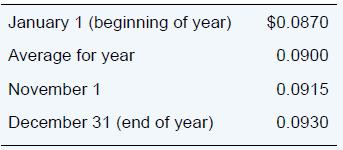

During the year, the company earned income of MXP270,000 and on November 1 declared dividends of MXP150,000. The Mexican peso is the functional currency. Relevant exchange rates between the peso and the U.S. dollar follow:

Required

a. Prepare a proof of the translation adjustment, assuming that the beginning credit balance of the Accumulated Other Comprehensive Income—Translation Adjustment account was $3,250.

b. Did the U.S. dollar strengthen or weaken against the Mexican peso during the year?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd