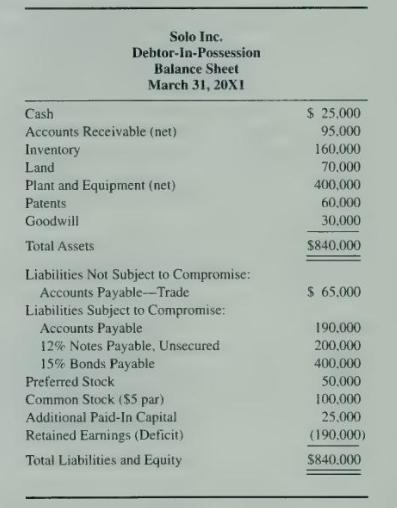

The balance sheet of Solo Inc., a company in reorganization proceedings, on March 31, 20X1, is as

Question:

The balance sheet of Solo Inc., a company in reorganization proceedings, on March 31, 20X1, is as follows:

The plan of reorganization was approved on March 31, 20X1, by the court, the stockholders, and the creditors. The plan included the following:

1. The accounts payable creditors subject to compromise agreed to accept the \(\$ 95,000\) of net accounts receivable, and 6,000 shares of newly issued no-par common stock having a value of \(\$ 36,000\) in settlement of their claims of \(\$ 190,000\).

2. The holders of the 12 percent unsecured notes payable for \(\$ 200,000\) agreed to accept the land with a fair value of \(\$ 100,000\), and 6,000 shares of newly issued no-par common stock having a value of \(\$ 36,000\).

3. The holders of the 15 percent bonds payable agreed to reduce the principal of the bonds to \(\$ 380.000\). Interest at 9 percent will be due annually on December 31 of each period from the date the plan of reorganization is approved onward, and the bondholders agreed to extend the maturity date of the bonds for an additional four years.

4. The preferred shareholders agreed to accept 1.500 shares of newly issued no-par-value common stock having a value of \(\$ 9,000\) in exchange for their preferred stock.

5. The common shareholders agreed to accept 1,500 shares of newly issued no-par-value common stock having a value of \(\$ 9,000\) in exchange for their prereorganization shares of common stock.

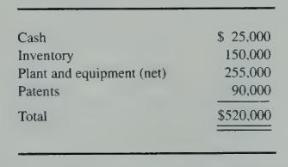

After extensive analysis, the reorganization value of the company at the date the plan of reorganization is approved is determined to be \(\$ 730,000\) before the payment of any assets as required by the plan of reorganization. The plan of reorganization is then completed and the remaining identifiable assets have fair values as follows:

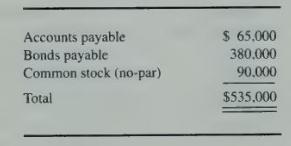

After consultation among the creditors, the court, and the management of the company, the postreorganization capital of the company will be:

\section*{Required}

a. Prepare a recovery analysis for the plan of reorganization.

b. Prepare an evaluation to determine if the company meets the two conditions necessary for fresh start accounting as it emerges from the Chapter 11 reorganization.

c. Prepare the journal entries to record the execution of the plan of reorganization.

d. Prepare a worksheet presenting the effects of the plan of reorganization on the company's balance sheet.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King