The Champion Play Company is a partnership that sells sporting goods. The partnership agreement provides for 10

Question:

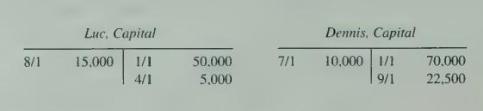

The Champion Play Company is a partnership that sells sporting goods. The partnership agreement provides for 10 percent interest on invested capital, salaries of \(\$ 24,000\) to Luc and \(\$ 28,000\) to Dennis and a bonus for Luc. The 20X3 capital accounts were as follows:

\section*{Required}

For each of the following independent situations, prepare an income distribution schedule.

a. Interest is based on weighted-average capital balances. The bonus is 5 percent and is calculated on net income after deducting the bonus. In 20X3, net income was \(\$ 64,260\). Any remainder is divided between Luc and Dennis in a 3:2 ratio, respectively.

b. Interest is based on ending capital balances after deducting salaries, which the partners normally withdraw during the year. The bonus is 8 percent and is calculated on net income after deducting the bonus and salaries. Net income was \(\$ 108,700\). Any remainder is divided equally.

c. Interest is based on beginning capital balances. The bonus is 12.5 percent and is calculated on net income after deducting the bonus. Net income was \(\$ 76.950\). Any remainder is divided between Luc and Dennis in a 4:2 ratio, respectively.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King