The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31,

Question:

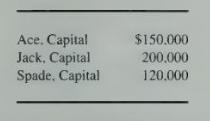

The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31, 20X5, Spade decided to retire from the partnership. The partnership balance sheet reported the following capital balances for each partner at December 31, 20X5:

The partners allocate partnership income and loss in the ratio 20:30:50.

\section*{Required}

Record the withdrawal of Spade under each of the following independent situations.

a. Spade's capital interest was acquired for \(\$ 150,000\) by Jack in a personal transaction. Partnership assets were not revalued, and partnership goodwill was not recognized.

b. Assume the same facts as in Required part \(a\) except that partnership goodwill applicable to the entire business was recognized by the partnership.

c. Spade was given \(\$ 180,000\) of partnership cash upon retirement. Capital of the partnership after Spade's retirement was \(\$ 290,000\).

d. Spade was given \(\$ 60,000\) of cash and partnership land with a fair value of \(\$ 120,000\). The carrying amount of the land on the partnership books was \(\$ 100,000\). Capital of the partnership after Spade's retirement was \(\$ 310,000\).

e. Spade was given \(\$ 150,000\) of partnership cash upon retirement. The portion of goodwill attributable to Spade was recorded by the partnership.

f. Assume the same facts as in Required part \(e\) except that partnership goodwill attributable to all the partners was recorded.

g. Due to limited cash in the partnership, Spade was given land with a fair value of \(\$ 100,000\) and a note payable for \(\$ 50,000\). The carrying amount of the land on the partnership books was \(\$ 60,000\). Capital of the partnership after Spade's retirement was \(\$ 360,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King