Select the correct answer for each of the following questions. 1. When property other than cash is

Question:

Select the correct answer for each of the following questions.

1. When property other than cash is invested in a partnership, at what amount should the noncash property be credited to the contributing partner's capital account?

a. Contributing partner's tax basis.

b. Contributing partner's original cost.

c. Assessed valuation for property tax purposes.

d. Fair value at the date of contribution.

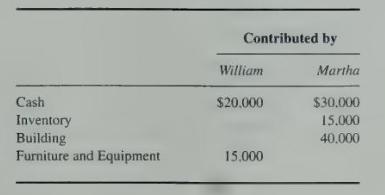

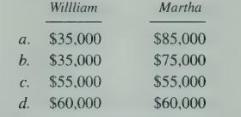

2. William and Martha drafted a partnership agreement that lists the following assets contributed at the partnership's formation:

The building is subject to a mortgage of \(\$ 10.000\), which the partnership has assumed. The partnership agreement also specifies that profits and losses are to be distributed evenly. What amounts should be recorded as capital for William and Martha at the formation of the partnership?

3. Smith and Duncan are partners with capital balances of \(\$ 60,000\) and \(\$ 20,000\), respectively. Profits and losses are divided in the ratio of 60:40. Smith and Duncan decided to form a new partnership with Johnson, who invested land valued at \(\$ 15,000\) for a 20 percent capital interest in the new partnership. Johnson's cost of the land was \(\$ 12,000\). The partnership elected to use the bonus method to record the admission of Johnson into the partnership. Johnson's capital account should be credited for:

a. \(\$ 12,000\).

b. \(\$ 15,000\).

c. \(\$ 16,000\).

d. \(\$ 19.000\).

4. On April 30, 20X5, Apple, Blue, and Crown formed a partnership by combining their separate business proprietorships. Apple contributed cash of \(\$ 50,000\). Blue contributed property with a \(\$ 36,000\) carrying amount, a \(\$ 40,000\) original cost, and \(\$ 80,000\) fair value. The partnership accepted responsibility for the \(\$ 35,000\) mortgage attached to the property. Crown contributed equipment with a \(\$ 30,000\) carrying amount, a \(\$ 75,000\) original cost, and \(\$ 55,000\) fair value. The partnership agreement specifies that profits and losses are to be shared equally but is silent regarding capital contributions. Which partner has the largest April 30, 20X5, capital account balance?

a. Apple.

b. Blue.

c. Crown.

d. All capital account balances are equal.

Questions 5 and 6 are based upon the following:

The Moon-Norbert Partnership was formed on January 2, 20X5. Under the partnership agreement, each partner has an equal initial capital balance accounted for under the goodwill method.

Partnership net income or loss is allocated 60 percent to Moon and 40 percent to Norbert. To form the partnership. Moon originally contributed assets costing \(\$ 30,000\) with a fair value of \(\$ 60,000\) on January 2. 20X5, while Norbert contributed \(\$ 20,000\) in cash. Drawings by the partners during \(20 \times 5\) totaled \(\$ 3,000\) by Moon and \(\$ 9,000\) by Norbert. Moon-Norbert's net income for \(20 \mathrm{X} 5\) was \(\$ 25.000\).

5. Norbert's initial capital balance in Moon-Norbert is:

a. \(\$ 20.000\).

b. \(\$ 25,000\).

c. \(\$ 40,000\).

d. \(\$ 60.000\).

6. Moon's share of Moon-Norbert's net income is:

a. \(\$ 15,000\).

b. \(\$ 12,500\).

c. \(\$ 12,000\).

d. \(\$ 7,800\).

7. In the Crowe-Dagwood partnership, Crowe and Dagwood had a capital ratio of \(3: 1\) and a profit and loss ratio of 2:1, respectively. The bonus method was used to record Elman's admittance as a new partner. What ratio should be used to allocate, to Crowe and Dagwood, the excess of Elman's contribution over the amount credited to Elman's capital account?

a. Crowe and Dagwood's new relative capital ratio.

b. Crowe and Dagwood's new relative profit and loss ratio.

c. Crowe and Dagwood's old capital ratio.

d. Crowe and Dagwood's old profit and loss ratio.

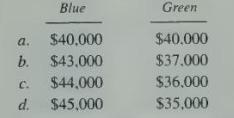

8. Blue and Green formed a partnership in 20X4. The partnership agreement provides for annual salary allowances of \(\$ 55,000\) for Blue and \(\$ 45,000\) for Green. The partners share profits equally and losses in a \(60: 40\) ratio. The partnership had earnings of \(\$ 80,000\) for 20X5 before any allowance to partners. What amount of these earnings should be credited to each partner's capital account?

9. When Jill retired from the partnership of Jill, Bill, and Hill, the final settlement of Jill's interest exceeded Jill's capital balance. Under the bonus method, the excess:

a. Was recorded as goodwill.

b. Was recorded as an expense.

c. Reduced the capital balances of Bill and Hill.

d. Had no effect on the capital balances of Bill and Hill.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King