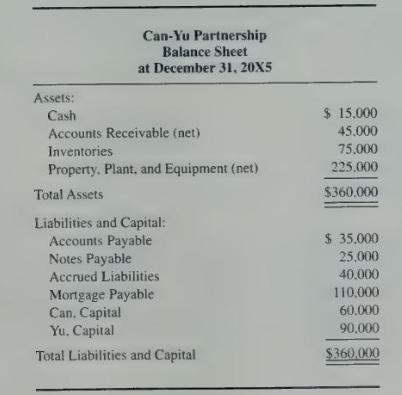

The balance sheet of the Can-Yu Partnership at December 31, 20X5, appears below: Can and Yu share

Question:

The balance sheet of the Can-Yu Partnership at December 31, 20X5, appears below:

Can and Yu share profits and losses in the ratio 30:70. On January 1, 20X6. Sea was admitted into the partnership.

\section*{Required}

Prepare journal entries for the admission of Sea for each of the following independent situations.

a. Sea acquired a 25 percent interest in partnership capital directly from Can and Yu for \(\$ 50,000\). Sea paid \(\$ 18,750\) directly to Can and \(\$ 31,250\) directly to Yu. Total assets of the partnership after the admission of Sea were \(\$ 360,000\).

b. Assume the same facts as in Required part \(a\) except that total assets of the partnership were \(\$ 410,000\) after the admission of Sea. At January 1, 20X6, inventories had a fair value of \(\$ 85,000\), while property, plant, and equipment (net) had a fair value of \(\$ 265,000\). Both Can and Yu decided to revalue the partnership's assets before the admission of Sea.

c. Sea acquired a 25 percent interest in capital by investing \(\$ 50,000\) of cash into the partnership. Total capital of the Can-Yu-Sea Partnership on January 1, 20X6, amounted to \(\$ 200,000\).

d. Sea acquired a 25 percent interest in capital by investing \(\$ 80,000\) of cash into the partnership. Total capital of the Can-Yu-Sea Partnership on January 1, 20X6, amounted to \(\$ 230,000\).

\(e\). Assume the same facts as in Required part \(d\) except that total capital of the Can-Yu-Sea Partnership after Sea's admission amounted to \(\$ 320,000\) due to the recognition of goodwill.

f. Assume the same facts as in Required part \(d\) except that total capital of the Can-Yu-Sea Partnership after Sea's admission amounted to \(\$ 320,000\). The fair value of the inventories was \(\$ 85,000\) and the fair value of the property, plant, and equipment (net) was \(\$ 305,000\) on January \(1,20 \times 6\).

g. Sea acquired a 25 percent interest in capital by investing \(\$ 30,000\) of cash into the partnership. Total capital after Sea's admission amounted to \(\$ 180,000\).

h. Assume the same facts as in Required part \(g\) except that total capital of the Can-Yu-Sea Partnership after Sea's admission amounted to \(\$ 200,000\) due to the recognition of goodwill.

i. Assume the same facts as in Required part \(g\) except that total capital of the Can-Yu-Sea Partnership after Sea's admission amounted to \(\$ 120,000\). The fair value of the inventories was \(\$ 65,000\) and the fair value of the property, plant, and equipment (net) was \(\$ 175,000\) on January 1. \(20 \times 6\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King