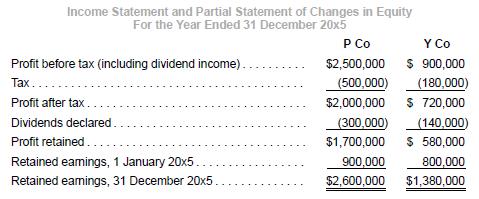

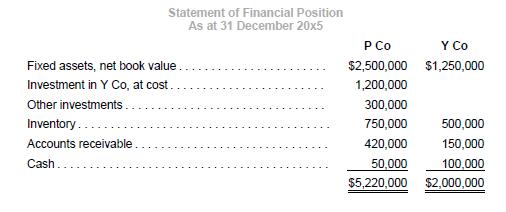

The financial statements of P Co and Y Co for the year ended 31 December 20x5 are

Question:

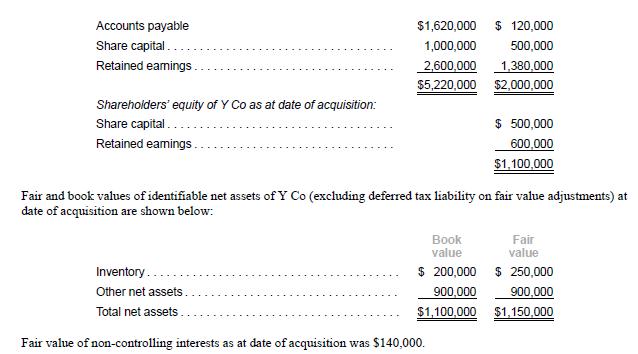

The financial statements of P Co and Y Co for the year ended 31 December 20x5 are shown below. P Co acquired a 90% interest in Y Co on 1 January 20x3.

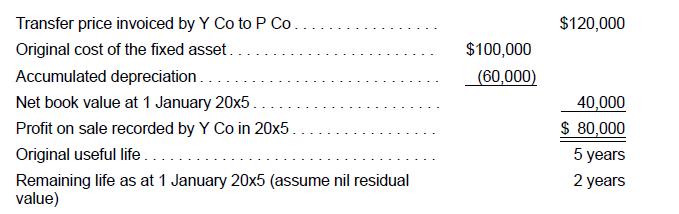

Additional information:

(a) Undervalued inventory of Y Co was sold to third parties in 20x4.

(b) Y Co transferred its fixed asset to P Co on 1 January 20x5. Details are as follows:

(c) Assume a tax rate of 20%. Tax effects should be recognized.

Required:

1. Prepare the consolidation adjustments for the year ended 31 December 20x5.

2. Perform an analytical check on non-controlling interests’ balance as at 31 December 20x5.

3. If P Co measures non-controlling interests as a proportion of identifiable net assets as at acquisition date, prepare the consolidation adjustment(s) that differs from 1, and perform an analytical check on non-controlling interests’ balance as at 31 December 20x5.

4. Perform an analytical check on consolidated retained earnings as at 31 December 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah