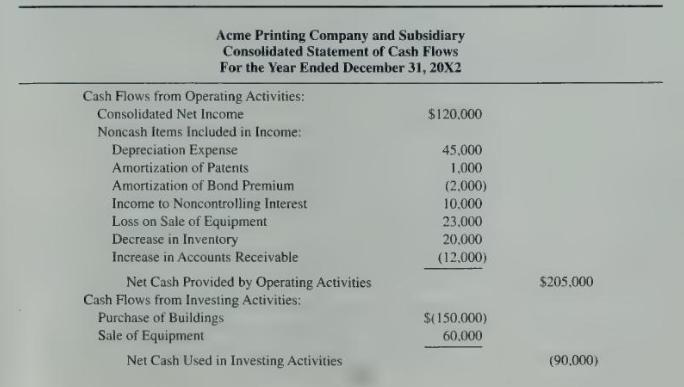

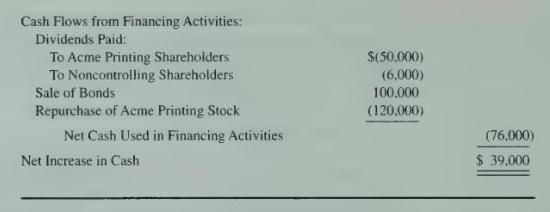

The following 20X2 consolidated statement of cash flows is presented for Acme Printing Company and its subsidiary,

Question:

The following 20X2 consolidated statement of cash flows is presented for Acme Printing Company and its subsidiary, Jones Delivery:

Acme Printing Company purchased 60 percent of the voting shares of Jones Delivery in 20X1 for \(\$ 40,000\) above book value.

\section*{Required}

a. Determine the net income of Jones Delivery for \(20 \mathrm{X} 2\).

b. Determine the amount of dividends paid by Jones Delivery in \(20 \mathrm{X} 2\).

c. Explain why the amortization of bond premium is treated as a deduction from net income in arriving at net cash flow from operating activities.

d. Explain why an increase in accounts receivable is treated as a deduction from net income in arriving at net cash flows from operating activities.

e. Explain why dividends to noncontrolling stockholders are not shown as a dividend payment in the retained earnings statement but are shown as a distribution of cash in the consolidated cash flow statement.

f. Did the loss on the sale of equipment included in the consolidated statement of cash flows result from a sale to an affiliate or a nonaffiliate? How do you know?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King