The following are transactions and events of the general fund of Sycamore Hospital, a not-for-profit entity, for

Question:

The following are transactions and events of the general fund of Sycamore Hospital, a not-for-profit entity, for the 20X6 fiscal year ending December 31, 20X6.

1. A total of \(\$ 6,200,000\) in patient services was provided.

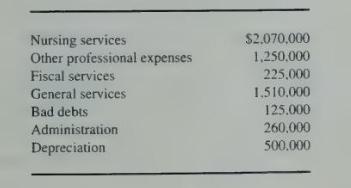

2. Operating expenses total \(\$ 5,940,000\), as follows:

3. Contractual adjustments of \(\$ 220,000\) are allowed as deductions from gross patient revenue.

4. A transfer of \(\$ 180,000\) is received from specific-purpose funds. This transfer is for payment of approved operating costs in accordance with the terms of the restricted gift.

5. A transfer of \(\$ 200,000\) is received from the temporarily restricted plant fund to fund the purchase of new equipment for the hospital.

6. Sycamore Hospital receives \(\$ 155,000\) of unrestricted gifts.

7. Accounts receivable are collected except for \(\$ 75,000\) written off.

8. A valuation of the other than trading securities investment portfolio of the general fund reports an increase in the market value from the beginning of the period of \(\$ 70,000\).

\section*{Required}

a. Prepare journal entries in the general fund for each of the transactions and events.

b. Prepare the statement of operations for the general, unrestricted fund of Sycamore Hospital.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King