Select the correct answer for each of the following questions. Questions 1 through 3 are based on

Question:

Select the correct answer for each of the following questions.

Questions 1 through 3 are based on the following data:

Under Dodge Hospital's established rate structure, the hospital would have earned patient service revenue of \(\$ 5,000,000\) for the year ended December 31,20X3. However, Dodge did not expect to collect this amount because of contractual adjustments of \(\$ 500,000\) to third-party payors. In May 20X3, Dodge purchased bandages from Hunt Supply Company at a cost of \(\$ 1,000\). However, Hunt notified Dodge that the invoice was being canceled and that the bandages were being donated to Dodge. On December 31, 20X3, Dodge had board-designated assets consisting of \(\$ 40,000\) in cash and investments of \(\$ 700,000\).

1. For the year ended December 31, 20X3, how much should Dodge report as net patient service revenue?

a. \(\$ 4,500,000\).

b. \(\$ 5,000,000\).

c. \(\$ 5,500,000\).

d. \(\$ 5,740,000\).

2. For the year ended December 31, 20X3, Dodge should record the donation of bandages as:

a. A \(\$ 1,000\) reduction in operating expenses.

b. A decrease in net assets released from restrictions.

c. An increase in unrestricted revenue, gains, and other support.

d. A memorandum entry only.

3. How much of Dodge's board-designated assets should be included in unrestricted net assets?

a. \(\$ 0\).

b. \(\$ 40,000\).

c. \(\$ 700,000\).

d. \(\$ 740.000\).

4. Donated medicines that normally would be purchased by a hospital should be recorded at fair value and should be credited directly to:

a. Unrestricted revenue.

b. Expense of medicines.

c. Fund balance.

d. Deferred revenue.

5. Which of the following would normally be included as revenue of a not-for-profit hospital?

a. Unrestricted interest income from an endowment fund.

b. An unrestricted gift.

c. Tuition received from an educational program.

d. All of the above.

6. An unrestricted gift pledge from an annual contributor to a not-for-profit hospital made in December 20X1 and paid in March 20X2 would generally be credited to:

a. Contribution revenue in 20X1.

b. Contribution revenue in \(20 \times 2\).

c. Other income in 20X1.

d. Other income in 20X2.

7. An organization of high school seniors assists patients at Lake Hospital. These students are volunteers and perform services that the hospital would not otherwise provide, such as wheeling patients in the park and reading to patients. Lake has no employer-employee relationship with these volunteers, who donated 5.000 hours of service to Lake in 20X2. At the minimum wage, these services would amount to \(\$ 18,750\), while it is estimated that the fair value of these services was \(\$ 25.000\). In Lake's \(20 \mathrm{X} 2\) statement of operations, what amount should be reported as donated services?

a. \(\$ 25,000\).

b. \(\$ 18,750\).

c. \(\$ 6,250\).

d. \(\$ 0\).

8. Which of the following would be included in the unrestricted funds of a not-for-profit hospital?

a. Permanent endowments.

b. Term endowments.

c. Board-designated funds originating from previously accumulated income.

d. Funds designated by the donor for plant expansion and replacement funds.

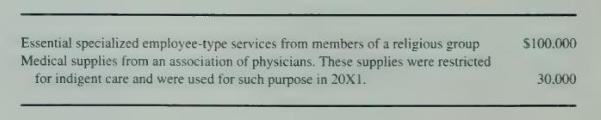

9. During the year ended December 31, 20X1, Greenacre Hospital received the following donations stated at their respective fair values:

How much total revenue from donations should Greenacre report its 20X1?

a. \(\$ 0\).

b. \(\$ 30,000\).

c. \(\$ 100,000\).

d. \(\$ 130.000\).

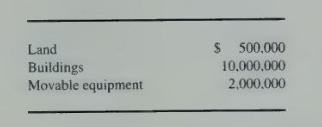

10. Johnson Hospital's property, plant, and equipment (net of depreciation) consists of the following:

What amount should be reported as restricted assets?

a. \(\$ 0\).

b. \(\$ 2,000,000\).

c. \(\$ 10,500,000\).

d. \(\$ 12,500,000\).

11. Depreciation should be recognized in the financial statements of:

a. Proprietary (for-profit) hospitals only.

b. Both proprietary and not-for-profit hospitals.

c. Both proprietary and not-for-profit hospitals, only when they are affiliated with a college or university.

d. All hospitals, as a memorandum entry not affecting the statement of revenue and expenses.

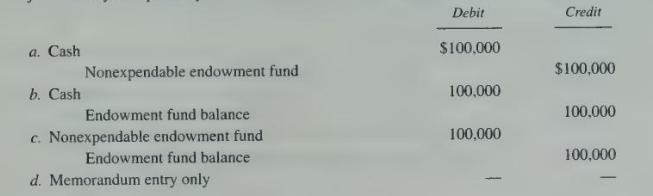

12. On March 1, 20X1, J. Rowe established a \(\$ 100,000\) endowment fund, the income from which is to be paid to Central Hospital for general operating purposes. Central does not control the fund's principal. Rowe appointed Sycamore National Bank as trustee of this fund. What journal entry is required by Central to record the establishment of the endowment?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King