Select the correct answer for each of the following questions. 1. For the summer session of (20

Question:

Select the correct answer for each of the following questions.

1. For the summer session of \(20 \mathrm{X} 2\), Pacific University assessed its students \(\$ 1,700,000\) (net of refunds), covering tuition and fees for educational and general purposes. However, only \(\$ 1,500,000\) was expected to be realized, because scholarships totaling \(\$ 150,000\) were granted to students, and tuition remissions of \(\$ 50,000\) were allowed to faculty members' children attending Pacific. What amount should Pacific include as revenues from student tuition and fees?

a. \(\$ 1,500,000\).

b. \(\$ 1,550,000\).

c. \(\$ 1,650,000\).

d. \(\$ 1,700,000\).

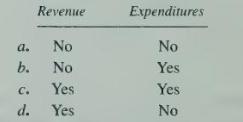

2. Tuition remissions for graduate student teaching assistantships should be classified by a university as:

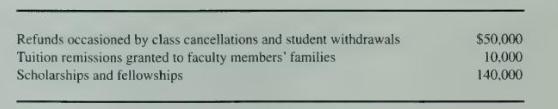

3. For the fall semester of \(20 \times 1\), Dover University assessed its students \(\$ 2,300,000\) for tuition and fees. The net amount realized was only \(\$ 2,100,000\) because of the following revenue reductions:

How much should Dover report for the period for revenue from tuition and fees?

a. \(\$ 2,100,000\).

b. \(\$ 2,150,000\).

c. \(\$ 2,250,000\).

d. \(\$ 2,300,000\).

Items 4 through 6 are based on the following information pertaining to Global University, a private institution, as of June 30, 20X1, and for the year then ended:

Unrestricted net assets comprised \(\$ 7,500,000\) of assets and \(\$ 4,500,000\) of liabilities (including deferred revenues of \(\$ 150,000\) ). Among the receipts recorded during the year were unrestricted

gifts of \(\$ 550,000\) and restricted grants totaling \(\$ 330,000\), of which \(\$ 220,000\) was expended during the year for current operations and \(\$ 110,000\) remained unexpended at the close of the year.

Volunteers from the surrounding communities regularly contribute their services to Global and are paid nominal amounts to cover their travel costs. During the year, the total amount paid to these volunteers aggregated \(\$ 18,000\). The gross value of services performed by them, determined by reference to equivalent wages available in that area for similar services, amounted to \(\$ 200,000\).

Global University normally purchases the types of coniributed services and the university feels the contributed services enhance its assets.

4. At June 30, 20X1, Global's unrestricted net asset balance was:

a. \(\$ 7,500,000\).

b. \(\$ 3,150.000\).

c. \(\$ 3,000,000\).

d. \(\$ 2,850,000\).

5. For the year ended June 30, 20X1, what amount should be included in Global's revenue for the unrestricted gifts and restricted grants?

a. \(\$ 550,000\).

b. \(\$ 660,000\).

c. \(\$ 770,000\).

d. \(\$ 880,000\).

6. For the year ended June 30, 20X1, what amount should Global record as expenditures for the volunteers' services?

a. \(\$ 218,000\).

b. \(\$ 200,000\).

c. \(\$ 18,000\).

d. \(\$ 0\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King