The following footnote was abstracted from a recent annual report of Johnson & Johnson Company: (square) section*{Footnote

Question:

The following footnote was abstracted from a recent annual report of Johnson \& Johnson Company: \(\square\)

\section*{Footnote 7: Foreign Currency Translation}

For translation of its international currencies, the Company has determined that the local currencies of its international subsidiaries are the functional currencies except those in highly inflationary economies, which are defined as those which have had compound cumulative rates of inflation of \(100 \%\) or more during the last three years.

In consolidating international subsidiaries, balance sheet currency effects are recorded as a separate component of stockholders' equity. This equity account includes the results of translating all balance sheet assets and liabilities at current exchange rates, except those located in highly inflationary economies. principally Brazil, which are reflected in operating results. These translation adjustments do not exist in terms of functional cash flows; such adjustments are not reported as part of operating results since realization is remote unless the international businesses were sold or liquidated.

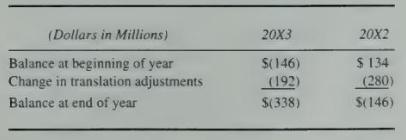

An analysis of the changes during \(20 \times 3\) and \(20 \times 2\) in the separate component of stockholders' equity for foreign currency translation adjustments follows (with debit amounts in parentheses):

a. What is the main point of the footnote?

b. How is the footnote related to the concepts covered earlier in the chapter?

c. List some possible reasons the company's translation adjustment decreased from a credit balance of \(\$ 134\) million at the end of \(20 \mathrm{X} 1\) to a debit balance of \(\$ 338\) million at the end of \(20 \times 3\).

d. Assume that the translated stockholders' equities of the foreign subsidiaries, other than the cumulative translation adjustment, remained constant from 20X1 through 20X3 at a balance of \(\$ 500\) million. What were the translated balances in the net assets (assets minus liabilities) of the foreign subsidiaries in each of the three years? What factors might cause the changes in the balances of the net assets over the three-year period?

e. How would changes in the exchange rates of the local currency units in the countries in which the company has subsidiaries affect the cumulative translation adjustment?

f. How could you verify the actual causal factors for the changes in the cumulative translation adjustment of Johnson \& Johnson Company for the years presented? Be specific!

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King