Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent company uses the Irish

Question:

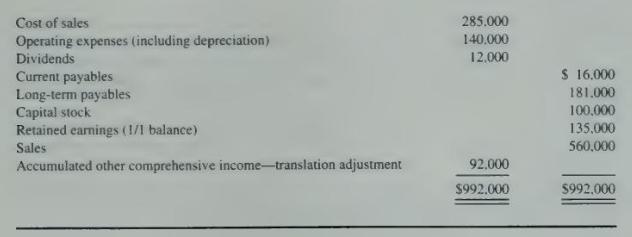

Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent company uses the Irish pound as the subsidiary's functional currency. At the beginning of the year, the debit balance in the accumulated other comprehensive income-translation adjustment account, which was the only item in accumulated other comprehensive income, was \(\$ 80,000\). The subsidiary's translated trial balance at the end of the year is as follows:

\section*{Required}

a. Prepare a statement of income, ending in net income, for the year, for the subsidiary.

b. Prepare a statement of comprehensive income for the year, for the subsidiary.

c. Prepare a year-end balance sheet for the subsidiary.

d. FASB 130 allows for alternative operating statement displays of the other comprehensive income items. Discuss the major differences between the one-statement format of the Statement of Income and Comprehensive Income versus the two-statement format of the Statement of Income with a separate Statement of Comprehensive Income.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King