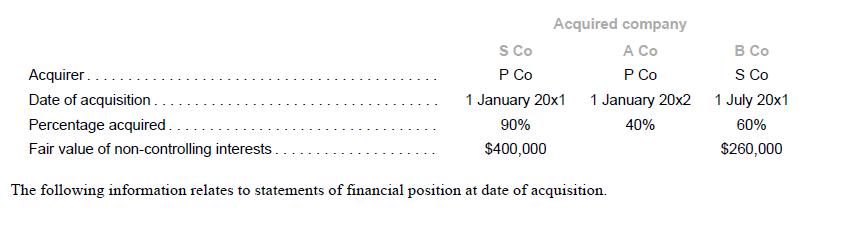

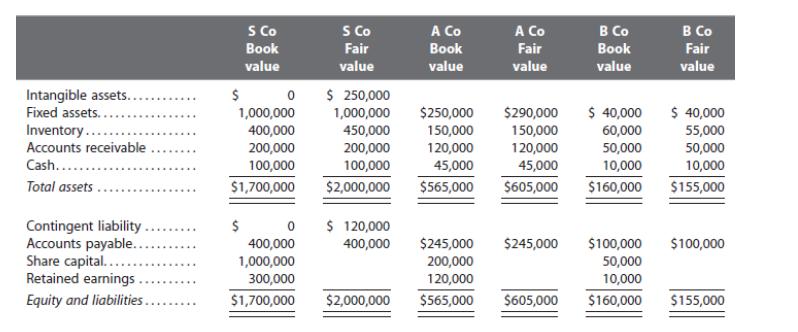

The following information relates to the acquisition of S Co, A Co, and B Co. Additional information

Question:

The following information relates to the acquisition of S Co, A Co, and B Co.

Additional information

(a) Intangible assets of S Co had an estimated useful life of five years from the date of acquisition by P Co.

Amortization on a straight line basis was deemed to be the appropriate method of recognizing the decline in value.

(b) Remaining useful life of the fixed assets of A Co at the date of acquisition was five years. Assume nil residual values.

(c) Inventory at the date of acquisition was sold off within the following financial period.

(d) The contingent liability of S Co at the date of acquisition was disposed of as follows: 50% of the contingent liability was settled by S Co in the year following acquisition; the remaining 50% of the contingent liability was deemed as unwarranted in the year of settlement.

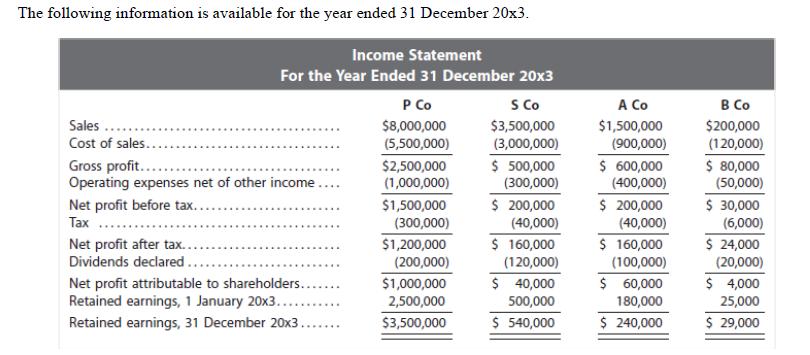

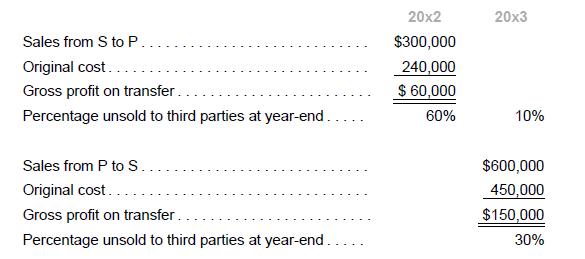

(e) The following sales of inventory were made during 20x2 and 20x3:

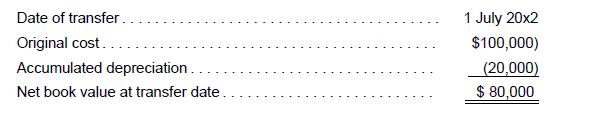

(f) The following transfers of fixed assets from A to P were made during 20x2:

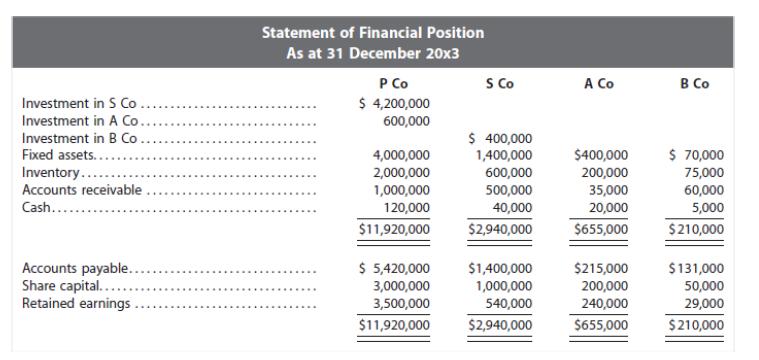

(g) There was no change in share capital of the acquired companies from acquisition date.

(h) Assume a tax rate of 20%. Recognize tax on fair value adjustments.

Required

1. Prepare the consolidation and equity accounting entries for the year ended 31 December 20x3.

2. Perform an analytical check on non-controlling interests of S Co as at 31 December 20x3.

3. Perform an analytical check on the investment in A Co as at 31 December 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah