Consider a pure exchange economy with two goods, (x,y), and two consumers, (1,2). Con- sumers' endowments are e (4,2) and e = (6,6) and

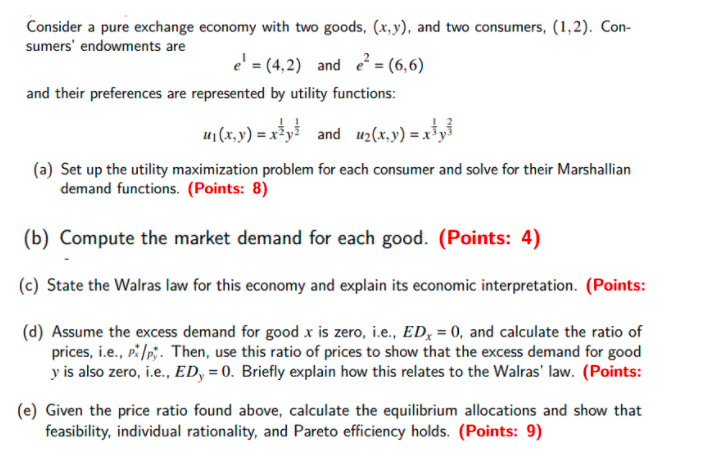

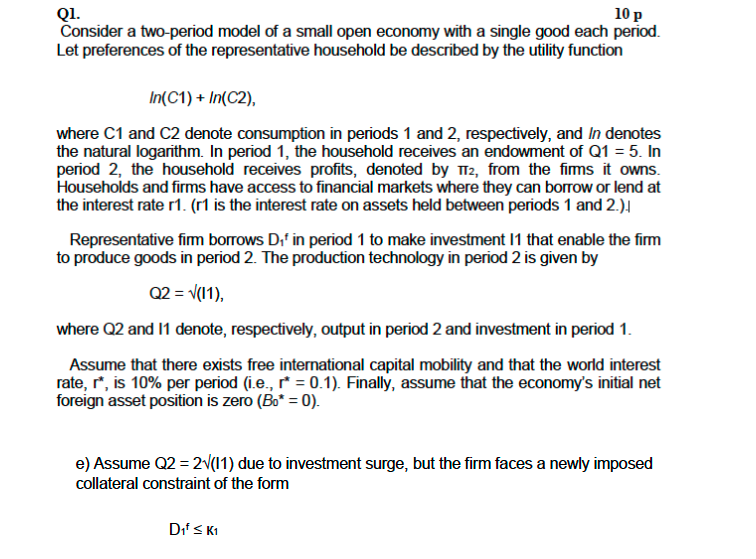

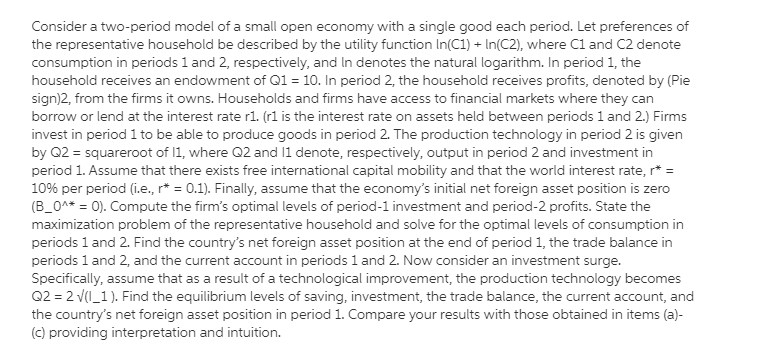

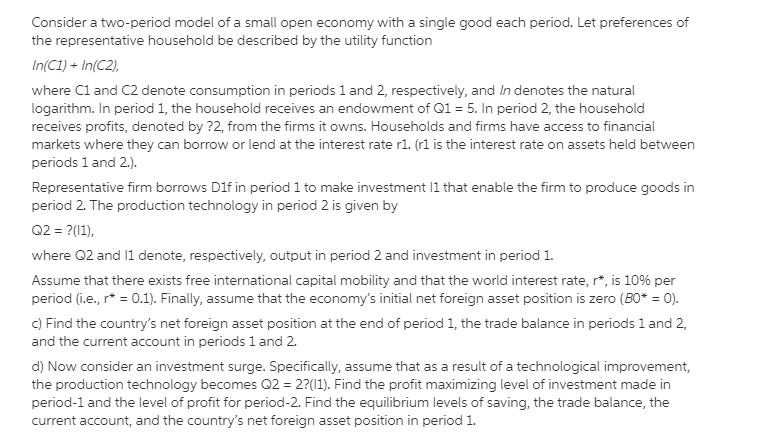

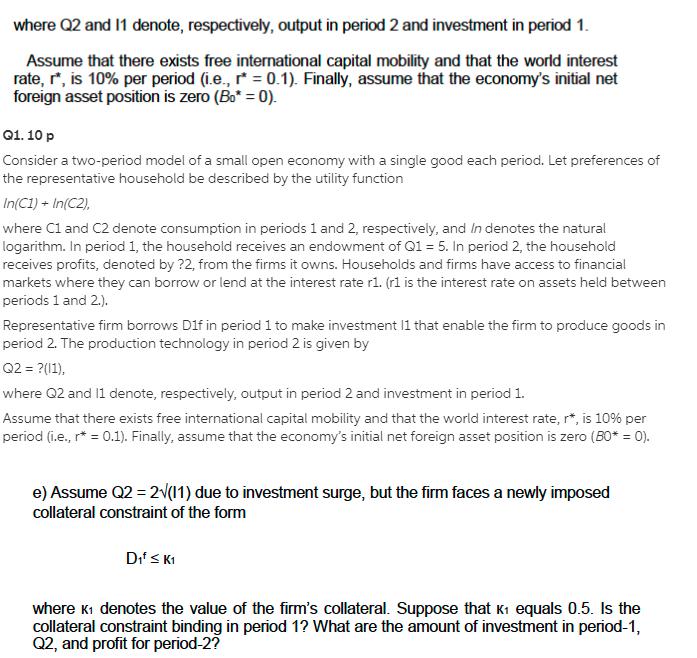

Consider a pure exchange economy with two goods, (x,y), and two consumers, (1,2). Con- sumers' endowments are e (4,2) and e = (6,6) and their preferences are represented by utility functions: u(x,y) = xy and u2(x,y) = x (a) Set up the utility maximization problem for each consumer and solve for their Marshallian demand functions. (Points: 8) (b) Compute the market demand for each good. (Points: 4) (c) State the Walras law for this economy and explain its economic interpretation. (Points: (d) Assume the excess demand for good x is zero, i.e., EDx = 0, and calculate the ratio of prices, i.e., p/p. Then, use this ratio of prices to show that the excess demand for good y is also zero, i.e., ED, = 0. Briefly explain how this relates to the Walras' law. (Points: (e) Given the price ratio found above, calculate the equilibrium allocations and show that feasibility, individual rationality, and Pareto efficiency holds. (Points: 9) Q1. 10 p Consider a two-period model of a small open economy with a single good each period. Let preferences of the representative household be described by the utility function In(C1) + In(C2), where C1 and C2 denote consumption in periods 1 and 2, respectively, and In denotes the natural logarithm. In period 1, the household receives an endowment of Q1 = 5. In period 2, the household receives profits, denoted by TT2, from the firms it owns. Households and firms have access to financial markets where they can borrow or lend at the interest rate r1. (r1 is the interest rate on assets held between periods 1 and 2.). Representative firm borrows D' in period 1 to make investment 11 that enable the firm to produce goods in period 2. The production technology in period 2 is given by Q2 = (11), where Q2 and 11 denote, respectively, output in period 2 and investment in period 1. Assume that there exists free international capital mobility and that the world interest rate, r*, is 10% per period (i.e., r* = 0.1). Finally, assume that the economy's initial net foreign asset position is zero (Bo* = 0). e) Assume Q2 = 2(11) due to investment surge, but the firm faces a newly imposed collateral constraint of the form Df K1 Consider a two-period model of a small open economy with a single good each period. Let preferences of the representative household be described by the utility function In(C1) + In(C2), where C1 and C2 denote consumption in periods 1 and 2, respectively, and In denotes the natural logarithm. In period 1, the household receives an endowment of Q1 = 10. In period 2, the household receives profits, denoted by (Pie sign)2, from the firms it owns. Households and firms have access to financial markets where they can borrow or lend at the interest rate r1. (r1 is the interest rate on assets held between periods 1 and 2.) Firms invest in period 1 to be able to produce goods in period 2. The production technology in period 2 is given by Q2 = squareroot of 11, where Q2 and 11 denote, respectively, output in period 2 and investment in period 1. Assume that there exists free international capital mobility and that the world interest rate, r* = 10% per period (i.e., r* = 0.1). Finally, assume that the economy's initial net foreign asset position is zero (B_0^* = 0). Compute the firm's optimal levels of period-1 investment and period-2 profits. State the maximization problem of the representative household and solve for the optimal levels of consumption in periods 1 and 2. Find the country's net foreign asset position at the end of period 1, the trade balance in periods 1 and 2, and the current account in periods 1 and 2. Now consider an investment surge. Specifically, assume that as a result of a technological improvement, the production technology becomes Q2 = 2 (I_1). Find the equilibrium levels of saving, investment, the trade balance, the current account, and the country's net foreign asset position in period 1. Compare your results with those obtained in items (a)- (c) providing interpretation and intuition. Consider a two-period model of a small open economy with a single good each period. Let preferences of the representative household be described by the utility function In(C1) + In(C2), where C1 and C2 denote consumption in periods 1 and 2, respectively, and In denotes the natural logarithm. In period 1, the household receives an endowment of Q1 = 5. In period 2, the household receives profits, denoted by ?2, from the firms it owns. Households and firms have access to financial markets where they can borrow or lend at the interest rate r1. (r1 is the interest rate on assets held between periods 1 and 2.). Representative firm borrows D1f in period 1 to make investment 11 that enable the firm to produce goods in period 2. The production technology in period 2 is given by Q2 = ?(11), where Q2 and 11 denote, respectively, output in period 2 and investment in period 1. Assume that there exists free international capital mobility and that the world interest rate, r*, is 10% per period (i.e., r* = 0.1). Finally, assume that the economy's initial net foreign asset position is zero (BO* = 0). c) Find the country's net foreign asset position at the end of period 1, the trade balance in periods 1 and 2, and the current account in periods 1 and 2. d) Now consider an investment surge. Specifically, assume that as a result of a technological improvement, the production technology becomes Q2 = 2?(11). Find the profit maximizing level of investment made in period-1 and the level of profit for period-2. Find the equilibrium levels of saving, the trade balance, the current account, and the country's net foreign asset position in period 1. where Q2 and 11 denote, respectively, output in period 2 and investment in period 1. Assume that there exists free international capital mobility and that the world interest rate, r*, is 10% per period (i.e., r* = 0.1). Finally, assume that the economy's initial net foreign asset position is zero (Bo* = 0). Q1. 10 p Consider a two-period model of a small open economy with a single good each period. Let preferences of the representative household be described by the utility function In(C1) + In(C2), where C1 and C2 denote consumption in periods 1 and 2, respectively, and In denotes the natural logarithm. In period 1, the household receives an endowment of Q1 = 5. In period 2, the household receives profits, denoted by ?2, from the firms it owns. Households and firms have access to financial markets where they can borrow or lend at the interest rate r1. (r1 is the interest rate on assets held between periods 1 and 2.). Representative firm borrows D1f in period 1 to make investment 11 that enable the firm to produce goods in period 2. The production technology in period 2 is given by Q2 = ?(11), where Q2 and 11 denote, respectively, output in period 2 and investment in period 1. Assume that there exists free international capital mobility and that the world interest rate, r*, is 10% per period (i.e., r* = 0.1). Finally, assume that the economy's initial net foreign asset position is zero (BO* = 0). e) Assume Q2 = 2(11) due to investment surge, but the firm faces a newly imposed collateral constraint of the form Df K1 where K1 denotes the value of the firm's collateral. Suppose that K equals 0.5. Is the collateral constraint binding in period 1? What are the amount of investment in period-1, Q2, and profit for period-2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The law of diminishing returns holds that as additional resources are devoted to producing a good th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started